In the future, people and the planet will be taken into account in an increasing number of investment decisions. Investors and ordinary people want more sustainable alternatives and responses to major societal challenges.

The changes appear as new options: for example, the investments of the Oil Fund of the state of Norway are guided by the ethical guidelines drawn up by the Norwegian Ministry of Finance. The fund does not make investments in companies that manufacture tobacco or nuclear weapons or that gain too large a share of their profits from coal combustion, for example.

The American Rockefeller Foundation also had change in mind when it launched the concept of impact investing more than 10 years ago, in 2008. Corporate responsibility, social entrepreneurship, microfinance and responsible investment were already familiar activities to the foundation. The foundation wanted to accelerate the growth of socially and ecologically productive investments, so it presented impact investing as part of responsible business operations. It wanted to emphasise an active corporate approach and the resulting impacts.

The idea of impact investing is to simultaneously aim for both measurable and positive social good as well as economic profit. It is also a way of increasing profitable co-operation between the private, public and third sectors, thus preventing problems threatening human welfare and the environment. Investors use the term impact investing for such activities.

Impact investing now attracts billions

The United States was a natural place for the creation of impact investing, since it has huge income gaps and people give hundreds of billions of dollars to charity every year. People do not hesitate to use private money for good purposes. Private individuals, companies and foundations make donations in fields such as healthcare, education and religion.

In Nordic welfare states, the situation is different: people are used to tax-funded public services.

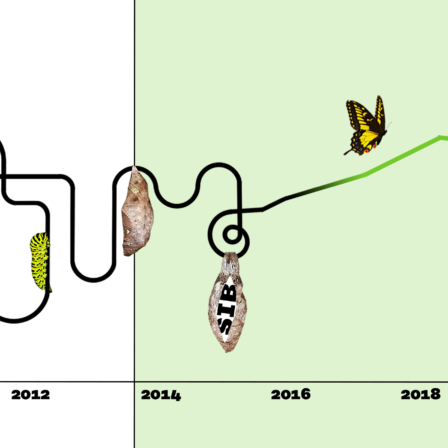

Impact investing began from nothing just over 10 years ago and estimates of the current market size vary. It is comparable in size in terms of value to Finland’s GDP, which was 234 billion euros in 2018.

According to an estimate from the Global Impact Investing Network (GIIN), the size of the global impact investing market was approximately 450 billion euros at the end of 2018. Last year, funds allocated to impact investing managed by GIIN members increased by 47% to 102 billion euros.

Sitra leads the way in Finland

Among the reasons for the growth have been concerns about climate change, the earth’s carrying capacity and inequality. Consumers and investors increasingly require that business activities are responsible and transparent and that they have positive societal impacts. They want methods that allow them to earn, save and spend money and invest in targets that have positive impacts on society.

Major banks – such as the UK’s Barclays, the American Merrill Lynch and Switzerland’s Credit Suisse – think tanks that influence political decision-making, foundations and universities have all joined global impact investing efforts. Active foundations have included such operators as the Ford Foundation and the Bill and Melinda Gates Foundation in the United States and Bertelsmann Stiftung in Germany.

In Finland, the first organisation to seize upon the idea of impact investing was Sitra, which started trials with social impact bonds (SIBs) in 2014. Currently, there are seven SIB project portfolios up and running or under way in Finland. Read more about SIB projects on Sitra’s website.

One of Sitra’s goals is to spread impact-oriented thinking to as large an audience as possible and to build an impact investing ecosystem in Finland. Its operation should be based on co-operation and interaction between funding providers, the public sector and service providers with the aim of creating value and new innovations.

Sitra’s work on the development of effective procurement and the SIB model finished at the end of 2019, but is being continued by the Centre of Expertise for Impact Investing, established by the Ministry of Economic Affairs and Employment.

Other initiatives have also been taken in Finland. At the end of 2018, the fully state-owned private equity company Tesi (Finnish Industry Investment Ltd) launched an of 75 million euros, as part of which it will pilot impact investing models.

Private equity seeks returns while doing good

Henri Grundstén, Development Director of Tesi, was among the first people in Finland to come across the idea of impact investing. “It felt like a win-win situation: private equity is seeking returns and it can do good at the same time. That’s why I thought there must be a high demand for this, and the demand must grow. Making profit and doing good are not mutually exclusive,” says Grundstén.

Grundstén is of the opinion that the rise of impact investing has taken surprisingly long, even though the new models could revolutionise the structures of the entire welfare society. Sitra’s work has also been slow to yield results. Ways of thinking change slowly, partly because of the conservatism of the financial market, and innovations emerge rarely. Local authorities have also been slow to adopt new ways of thinking.

According to Jenni Airaksinen, University Lecturer in Municipal and Regional Management at Tampere University, local authorities have actually changed the way they think in five years. The more information they have, the more opportunities the office holders and elected officials see.

Airaksinen points out that reforms related to new ideas are difficult for local authorities because there are many interests represented in the debate, the issues are multidimensional, and the problems to be addressed are often “wicked”. Inequality cannot be solved by individual methods and it is not easy for local authorities to favour one group of people over others when starting to use resources in a new way. Ultimately, all local residents with their problems and lives are in the hands of local authorities.

Decisions are made under pressure, where professionals meet local politics, and it always takes time to make any major changes.

“At first, there was a general suspicion around investing in municipal activities. It was believed that local authorities would be exploited and major investors would start benefiting at the expense of local authorities. There were several discussions about the subject, and it was highlighted that this was simply one way of creating opportunities for change in the system, particularly when it comes to investing in preventive action,” Airaksinen says. Now though, Airaksinen believes that attitudes have changed and suspicion has decreased as more experience has been gained.

According to Grundstén, the development of impact investing is driven by the climate crisis and its prevention. He points out that the zero-interest-rate environment also has such an effect that investors are seeking returns from several new investment products. Zero interest rates and some current negative interest rates in particular have the effect that fixed-income investments, previously considered almost risk-free, brought a steady, albeit relatively low, return, and, therefore, some of the investment assets had been steered towards them. When the interest rates are negative, investment assets must be invested elsewhere. In such a case, investors will look for new areas of investment where they are prepared to accept even lower risk-adjusted returns than before.

Impressive growth

Grundstén believes the change has also been driven by the fact that new generations are starting to manage large assets. He points out that they are more prepared to act in a new way. In his view, they are also promoting impact investing in such a manner that in the venture capital industry all investments are gradually shifting towards impact investing. Investors are beginning to seek positive indirect impacts, such as solutions to problems.

The trend is visible in many countries. For example, according to the Rockefeller Foundation’s assessment, in China the volumes of both charity and impact investing have started to grow.

Philippe Le Hoûérou, Director of the World Economic Forum, described the growth rate of impact investing as “impressive” in a 2018 article. He pointed out that impact investing can be used for addressing the world’s most pressing problems, such as climate change. However, that requires the involvement of institutional investors.

According to Hoûérou, the growth of impact investing requires that the concept of impact is defined clearly and transparently, and that everyone knows the basic principles of impact.

Finland’s role acknowledged globally

In Finland, the thinking has evolved in such a manner that it has become customary to include the pursuit of impact in all public spending. It is also reflected in the Government Programme: in September 2019, the Ministry of Finance set up the Effective Public Procurement Action Plan (Procurement Finland) together with the Association of Finnish Local and Regional Authorities. The aim is to publish a joint public procurement strategy for the whole of Finland in autumn 2020. Its objective is to promote the societal impact of funds spent on public procurement and the sustainability of public finances.

The Finnish Association for Social Enterprises (ARVO) represents 65 member companies. According to Kimmo Lipponen, CEO of ARVO, Finland already has the courage to seek societal change through impact investing. SIB projects are a good example of this.

The same outcomes-based principle can also be followed in public procurement. In this case, it is essential that public procurement officers take impact into account as often as possible in their own procurement activities. One positive sign is the fact that the Ministry of Economic Affairs and Employment aims to make impact one of the procurement criteria for public procurement.

Other countries have also acknowledged Finland’s efforts to invest for impact. The Social Impact Investing Initiative of the United Nations Office for Project Services (UNOPS) opened its office in Finland in autumn 2019. In addition, UNOPS will transfer the management of its global innovation work to Finland. According to the Finnish Ministry for Foreign Affairs, UNOPS selected Helsinki as the location because of Finland’s attractive environment for innovation and impact investment, the openness of Finnish society and low level of corruption.

Even though Finns are still in the early phases of impact investing, the interest in it is high among investors. It probably requires the involvement of institutional investors, such as employment pension organisations, before impact investing gains wider popularity in Finland. With their own investment criteria, institutional investors have already significantly contributed to bringing responsible investing onto the daily agenda of capital investors. Next, they may increase the importance of impact investing, as has already happened on an international scale.

Recommended

Have some more.