Sitra commissioned a second “The future of European companies in the data economy” survey to gain an insight into the awareness, attitudes and capabilities of large corporations and SMEs when it comes to responding to the business opportunities offered by the data economy. The survey was carried out in four countries, the Netherlands, France, Germany and Finland, and was conducted as part of Sitra’s IHAN® fair data economy project.

Lack of data economy expertise and regulation seen as stumbling blocks

The survey results revealed that the complexity of legislation (30%) and lack of expertise in business models (25%) are the biggest challenges to embracing the data economy. Other significant obstacles included customers not recognising the potential of the new services (23%) and gaps in a company’s technical capabilities (22%).

Country-specific differences were significant. Customers’ inability to recognise the potential of the new services was the biggest challenge among Finnish companies (31%). In all three of the other reference countries – Germany (31%), France (36%) and the Netherlands (32%) – it was legislation, particularly, that was considered the main stumbling block.

When asked to assess their data economy maturity level, only 34% of them have a data strategy that includes a data-sharing aspect. In France, nearly half (48%) of the companies have a data strategy. When assessing the overall situation, almost half (47%) of all responding companies felt that they have the necessary skills to function as an active member of the data economy.

Opportunities offered by data sharing are difficult to grasp

According to various studies (such as the ETLA Report 93, 2019: What Are the Benefits of Data Sharing?), in the future, the main benefits of the data economy will come from sharing data in ecosystems. However, the rather negative attitude among those responding to the Sitra survey indicates that companies do not think so.

Firms in Germany (47%) and the Netherlands (50%) estimated that the area where the main opportunities offered by data sharing can be found is innovation, whereas Finnish companies considered it to be cost savings (45%). A total of 54% of the French companies participating in the survey estimated that the revenue potential created by data sharing in their current business models is either large or very large – this differed considerably from the other countries.

It is increasingly challenging to create competitiveness through data

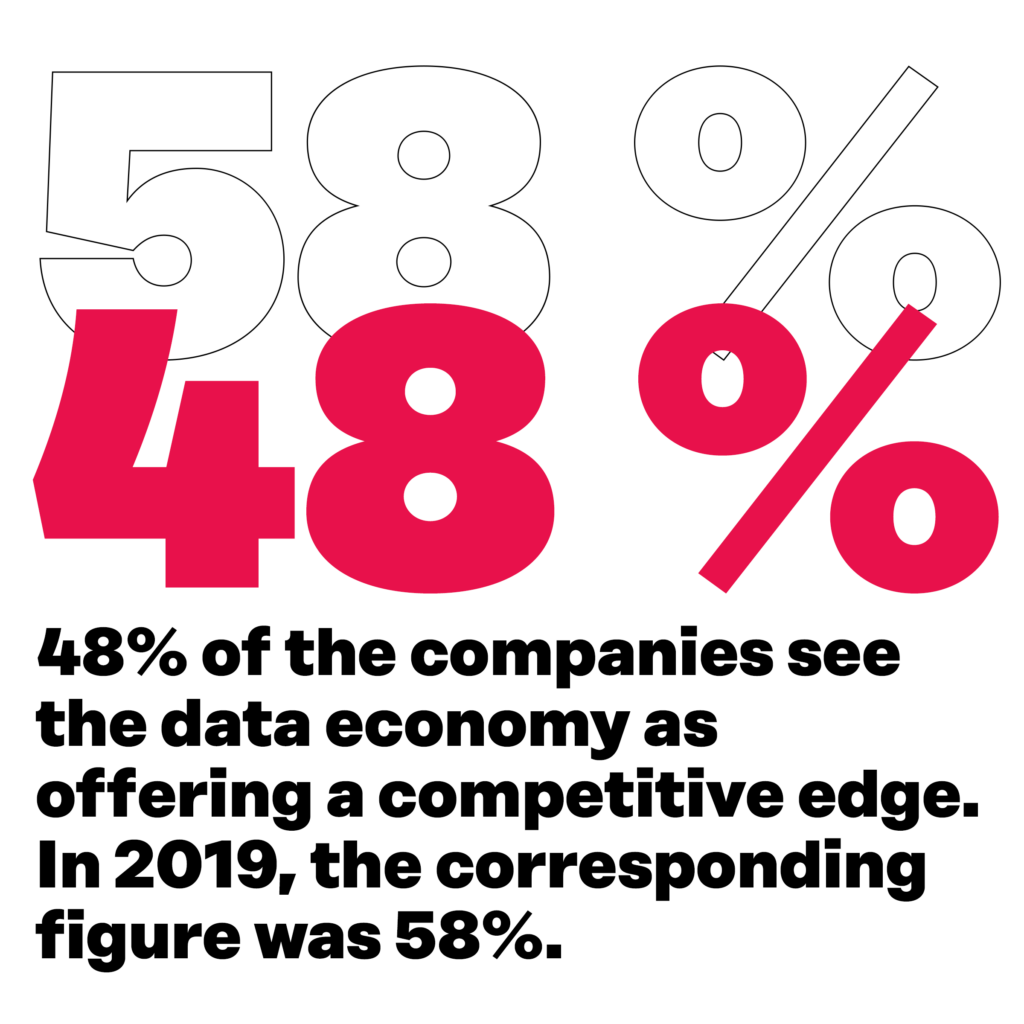

The majority of the respondents think that the data economy has positive effects on their organisation. The share of the respondents who think that it has already benefited them has decreased as competitors catch up. In the 2021 survey, only 48% of the respondents see the data economy as offering a competitive edge for them, either now or in the future. The decrease compared to the results from two years ago is 10%; in other words, the change in attitudes is significant. Uncertainty has increased in all four countries compared to 2019.

The Finnish companies that responded to the survey still have a more pessimistic attitude towards the opportunities offered by the data economy than the other reference countries: only 35% of Finnish companies see the data economy as offering a competitive edge for them. Finnish companies feature prominently (48%) among those that have doubts about the data economy. French companies continue to be the most positive (58%), although the share of doubting companies has grown. Among Dutch companies, the share of companies with a positive view has decreased the most (–13%).

However, what was positive was that companies have started tackling the obstacles highlighted in the survey by making changes to their business models. Despite the lack of expertise in the area, 72% of companies had made some kind of change to their business model during the past two years.

When it comes to changing elements of their business models, between 11 and 13% of respondents say they had made some changes. In France, the areas in which changes have mostly been made are the revenue models, the value propositions, partners and activities. In Germany, the changes made usually concern the business model, customers and channels. In Finland, resources was the category in which the most prominent changes were made.

Standing out from competitors with a “fair data label”

A company can use different labels, badges or certificates to prove to its partners and customers that it is reliable. According to the survey, significantly less than half of the companies believe that a “fair data label”, similar to the fair trade label, would benefit consumer business (41%) or B2B business (43%).

Among all the reference countries, Finland is the one in which companies have least faith in a fair data label: it provided the highest proportion of those who believe the label to be of no benefit and the lowest proportion of those who think it would be of great benefit.

There are significant differences between consumers’ and companies’ views of the benefits of a fair data label: consumers wish there were an easy way to distinguish fair data economy services from other services. The results of Sitra’s second data economy survey among the general public (in the Netherlands, France, Germany and Finland, 2021) show that in all the survey countries, consumers believe a fair data label to be very or somewhat important (71%), with the percentage clearly growing from 2018 (66%). The percentage is the highest among German consumers (75%).

So far, companies do not seem to consider trust felt by customers as an important way to stand out: just under half (48%) of the companies responding to the survey had taken action to increase customers’ trust. On the other hand, 37% of the consumer survey respondents say that lack of trust is still a significant obstacle to using digital services.

The survey was conducted as part of Sitra’s IHAN project, which lays a foundation for a fair data economy. In such an economy, successful digital services are based on trust and create value for everyone.

Read more