Background

The Employment SIB is a Ministry of Economic Affairs and Employment (MEAE) project, which aims to reduce long-term unemployment using the outcomes-based financing model (a social impact bond, SIB). The MEAE’s goal is to bring 3,000 jobseekers within the sphere of the Employment SIB’s services over a period of five years. Employment-promoting services will be offered to the long-term unemployed within the territory of several Employment and Economic Development Offices.

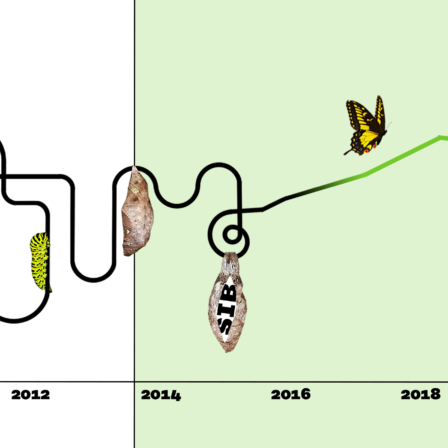

The main stages in the creation of this project have been described in the article Employment SIB on the road to implementation! This article will provide a more detailed examination of the selection of the SIB’s performance-fee mechanisms and of the development suggestions for the evaluation of the impact of employment measures that were generated in the course of the process.

Objective

The objective chosen for the Employment SIB was that of sustained employment. The goal is for the jobseeker to remain in the labour market, via either a long-term employment contract or an improvement in their ability to find work (in other words, the person will be able to find a new job if the employment contract terminates). This means that mere training, or starting a job, will not alone suffice as evidence of lasting employment – and, consequently, neither will it suffice as a basis for the performance fee.

The intervention and observation phase will last for three years. This was estimated as providing sufficient time, even though no suitable research data on this topic was available. New information on this topic will be obtained via the Employment SIB, since the permanence of the employment of the long-term unemployed will be observed over a long period of time.

Performance fee

Earned income was selected as the basis of the performance fee; information on this will be obtained from the tax authorities based on the social security number. The performance fee is determined as a percentage of salary, in such a way that the state will always obtain greater tax revenue and savings from unpaid benefits than the performance fee that it pays to the SIB (a more technical study report on this topic is under preparation). In practice, the economic benefit obtained by the state will thus vary according to the person’s earned income, since the performance fee paid to the SIB by the state is a predetermined, fixed proportion of salary.

In order to determine the level of the performance fee, we assessed how the long-term unemployed have previously found work. Since this is largely a question of structural unemployment, employment is not dependent on business cycles, nor do the reasons for the prolongation of unemployment often stem from a lack of jobs. For this purpose, we collected data from the tax authorities on salaries, pensions, unemployment benefits and the income taxes paid on these. This provided an understanding of the duration of unemployment, and of what happened to the people concerned following their spell of unemployment. In addition to the data from the tax authorities, we were given access to data on income support from the Social Insurance Institution of Finland (Kela) and the Finnish Institute for Health and Welfare; this is not taxable income, and thus does not show up in the figures of the tax authorities.

The sample chosen was all people who started a period of unemployment in 2013, a total of 417,691 people. In the case of 72,298 of these, the period of unemployment lasted for at least a year. Since the SIB’s target group is the long-term unemployed, it was only the latter group that was selected for cost analysis.

The long-term unemployed are not a homogenous group; rather, many different factors underlie the prolongation of unemployment. By creating a number of price segments, it is possible to make each unemployed person equally worth supporting from the viewpoint of the SIB, and so the service provider also has incentives to work equally actively with every member of the target group. This also reduces the opportunities for “creaming”.

The project tendering took place using the competitive dialogue procedure with the support of Hansel Oy and the Finnish Innovation Fund Sitra. This dialogue helped to ensure that the actual invitation to tender and its performance-fee model corresponds to the MEAE’s objectives.

The performance-fee model was based on duration of unemployment, age and education. To keep things simple, the duration of unemployment was divided into three parts: those who had been unemployed for one to two years; for two to three years; and over three years. Similarly, level of education was classified into three parts: comprehensive school, secondary education and higher education. The generations were also divided into three: under 25, 26-55 and over 55.

In the case of background factors, the segmentation criterion was that these had an impact on the average length of unemployment. On the basis of the data, we also know that the unemployment of people who have only comprehensive education becomes prolonged more easily than in the case of those with higher education; middle-aged people find work in ways that are different from those approaching retirement, or young people; and the prolongation of unemployment in itself is generally a prediction of weaker employability than in the case of a shorter period of unemployment.

We obtained a total of 27 price segments (3 x 3 x 3 = 27). For each of these, a salary estimate was set based on historical salaries. The estimate thus depicts what would happen in the current system in any case without SIBs.

In the pricing, the action areas were also divided into three groups: the Greater Helsinki metropolitan area with its neighbouring municipalities; the growth centres; and other areas. Even though tax euros are the same value throughout Finland, obtaining the same result requires a different amount of work and cost depending on the locality, for example as a result of distances and other costs.

The Employment SIB’s final fee level was established in discussions between the project administrator chosen via competitive tendering and representatives of the MEAE.

Benchmarking

The Employment SIB performance fee is not based on randomised control group benchmarking. When correctly organised, randomised control group benchmarking gives a more precise estimate of the impact of the SIB’s activity, but this entails its own challenges.

Randomised control group benchmarking may weaken the SIB’s ability to achieve results, or lower the benefits obtained by society by producing inefficiency in the operations. Furthermore, the SIB’s activity may also affect the control group. In scientific research the above points may well be controlled, but in large-scale, practical situations their control is difficult.

- One particular problem in the Employment SIB is that no data would be obtained on the participation of unemployed people in the control group in other employment projects, let alone on the costs of these competing projects.

- The Employment SIB takes some of the unemployed out of the sphere of public administration services, and so the public administration has more time to manage those unemployed people not involved with the SIB. This surplus resource cannot however be allocated to the control group of unemployed people, since in that case the control group will not depict the situation without SIBs. The public administration, which is already scantily resourced, often finds this to be problematic.

- The employment of the control group – and at the same time, the SIB’s fee – can change during the contract period, for example due to extraordinary employment promotion measures or political changes. In the latter case, in particular, there is a danger that the SIB will obtain part of the performance fee “for free”, rather than by its own merits. (This problem is not solely linked to outcomes-based purchasing, but also applies to traditional performance-based purchasing.) In the case of the Employment SIB there was no major legal reform on the horizon that would in some way or the other clearly improve the employment prospects of this difficult target group in comparison to the previous situation.

- Often, one of the objectives set in the SIB, in addition to effective action, is development of more effective action on the part of the municipality and/or the state. When an SIB’s performance fee is based on control group benchmarking, an incentive structure is created that makes it difficult to transfer expertise and know-how to the public sector.

Knowledge-based management

Even though the Employment SIB’s performance fee is not based on control group benchmarking, this does not mean that no comparison ought to be done. Instead of measuring the impact of the individual SIB to the exact cent, it would be important to develop the monitoring of the impact of the employment measures as a whole. Currently, the assessment of the success of employment measures is more speculation than science.

The assessment and development of effective employment measures requires up-to-date monitoring data on the results of the employment services provided, so that the less effective services can be distinguished from the more effective ones. The placing of unemployed people in employment can easily be monitored from the income register, even in the case of an individual unemployed person, and the effectiveness and costs of the different services thus compared. Via this method, the management of employment services could be based on actual and up-to-date information and data on which measures are cost-effective in the various different customer segments.

If up-to-date information on all unemployed people were to be available, it would be possible to compare the various services and their effectiveness and to choose the best of these. If the SIB does not do well in this competition, but instead it turns out that some other service produces a better outcome (or the same outcome, but more cheaply), then it will not be worth continuing the SIB’s activity; rather, the more efficient services ought to be adopted. And the same of course applies in reverse.

Allocation of cost responsibility

As stated above, it is difficult to assess the impact of employment measures. It is equally difficult to assess their impact on government finances. This assessment is often made on a very narrow basis and from only one viewpoint, that of direct costs. Unemployment gives rise to direct costs via, for example, earnings-related unemployment benefit and tideover allowance, on both of which income tax is payable. The fact that a person finds work may even reduce municipal taxes in the short term, since more income tax is payable on unemployment benefits than on the same amount of salary.

Tideover allowance is paid by the state and by the municipality. The municipality’s contribution varies between 0 and 70 per cent, depending on the duration of the unemployment. This penalty-type form of contribution aims to create an incentive for municipalities to place people in work.

Unemployment generates a number of other costs in addition to unemployment benefits, for example from housing benefit and income support as well as from lost income taxes and occupational pensions. Healthcare costs may also rise. The municipal contribution to tideover allowance thus represents only part of the costs of unemployment to the public administration (see Cabinet Office publication, 21 January 2019).

If the municipality makes decisions on employment measures in a narrow way solely on the basis of savings in the municipal contribution to tideover allowance, the final result will not necessarily make sense from the humane aspect, let alone from the viewpoint of taxpayers. A narrow analysis will transfer costs, which will have to be paid by some other public administration organisation (for example, bogus job creation can be used to shift the municipality’s penalty payments back to the state). And even if the activity is profitable in overall economic terms, it will not necessarily be profitable for an individual organisation (the municipality may not be capable of or eager for the activity, if the municipality’s own savings in tideover allowance are smaller than the cost of the employment, with the savings and income going to other parties).

From the point of view of incentives, it would be desirable if the party that is responsible for employment could make the decisions on an overall economic basis, and not narrowly in a way that optimises a single component area.

The municipalities do not currently have adequate tools that would enable them to monitor the impact of employment-promotion measures on employment. From the viewpoint of taxpayers, it would make sense if the parties responsible for employment obtained the essential employment data, and a cost-benefit analysis was carried out from the viewpoint of total costs (including all the material public administration economic benefits).

Of course, the effectiveness of employment measures is studied to some extent; for example, results are available regarding the activity of job banks (see ETLA’s report, 17 November 2017). Such studies are of course desirable, but the results arrive hopelessly too late in relation to the need for information, and they do not remove the need for the monitoring of outcomes; it is not sufficient to do the right things, it is also necessary to do them correctly.

In a rapidly changing world, the previous effectiveness of an activity does not necessarily guarantee effectiveness in the future. With the current opportunities provided by digitisation, outcomes ought to be available almost in real time, meaning that the benefits of employment promotion measures could also be evaluated in a timely fashion. Even the use of evidence-based procedures does not guarantee the effectiveness of these procedures; even in these, the measurement of outcomes is required, so that we can see whether the procedure is being applied correctly, and in the right target group.

Recommended

Have some more.