Awareness of the impacts of climate change has increased rapidly in recent years, and more and more companies and investors have set targets for reducing carbon emissions. Investors can contribute to mitigating climate change by encouraging companies to engage in low-carbon business and by financing climate solutions.

The Paris Agreement aims to limit global warming to 1.5 °C, which requires rapid emissions reductions. Sitra will also develop its investment activities to better support the goals of the Paris Agreement.

The purpose of Sitra’s climate strategy for investments is to mitigate climate change. This is also one of the primary sustainability goals in Sitra’s investment activities.

The climate strategy is used for both managing climate risks related to investments and for trying to identify future profit opportunities.

As a signatory to the UN Principles for Responsible Investment (PRI), Sitra is committed in its climate reporting to complying with the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and its requirements.

The climate strategy for investments also takes into account the recommendations and principles of some of the most significant international initiatives, including the UN-convened Net-Zero Asset Owner Alliance, the Institutional Investors Group on Climate Change (IIGCC) and the Science Based Targets Initiative (SBTi). In addition, Sitra’s climate strategy for investments sets climate-related targets for Sitra’s investment portfolio and specifies the measures for achieving these targets. The climate strategy is updated regularly, and the targets are reassessed in accordance with the latest research data and along with potential changes in the investment environment.

Decision-making and responsibilities

The climate strategy for investments is part of Sitra’s responsible investment practices. Moreover, responsible investment activities are steered by the guidelines approved by Sitra’s Board of Directors.

For Sitra, responsible investing means taking account not only of the return and risk but also of the environmental, social and governance (ESG) factors in all investment decisions. Among environmental factors, climate change mitigation is one of Sitra’s most important sustainability goals. Biodiversity has been identified as the next focus area for responsible investment.

Climate change-related issues are prepared and implemented in accordance with the same principles as any other matters related to responsible investment. Sitra’s Board of Directors approves both the Guidelines for Responsible Investment and the Climate Strategy for Investments. Sitra’s Vice President (Investments) is in charge of organising the implementation of the responsible investment guidelines, while all persons involved in investment operations are responsible for the implementation of Sitra’s responsible investment activities. Responsible investment topics are regularly reviewed at the investment team’s weekly meetings. Matters related to the climate strategy are addressed in close collaboration with other Sitra experts.

Investment matters related to climate change are regularly reported to Sitra’s Board of Directors. Sitra also reports annually to the PRI on its responsible investment practices.

Time span and coverage of the strategy

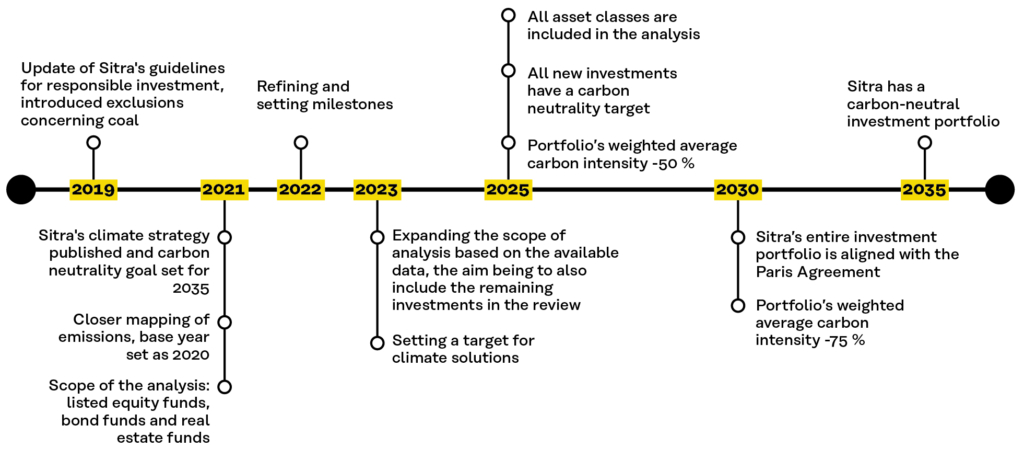

The global transition to carbon neutrality will take several decades, which means that the time span of the climate strategy for investments must also be long. In spite of the continuous increase in the reliability and coverage of science-based information, there is still a significant degree of uncertainty associated with the development path. Therefore, Sitra’s strategy is divided into milestones and specified as more information becomes available and as the investment market develops, approximately every two to three years.

In the early stages, the monitoring and targets included in Sitra’s climate strategy cover the listed equity funds, fixed income funds and real estate funds. This is because there is already a moderate amount of data available on these asset classes. In the coming years, the monitoring will expand to other asset classes as data coverage increases.

Climate risks, climate opportunities and risk management

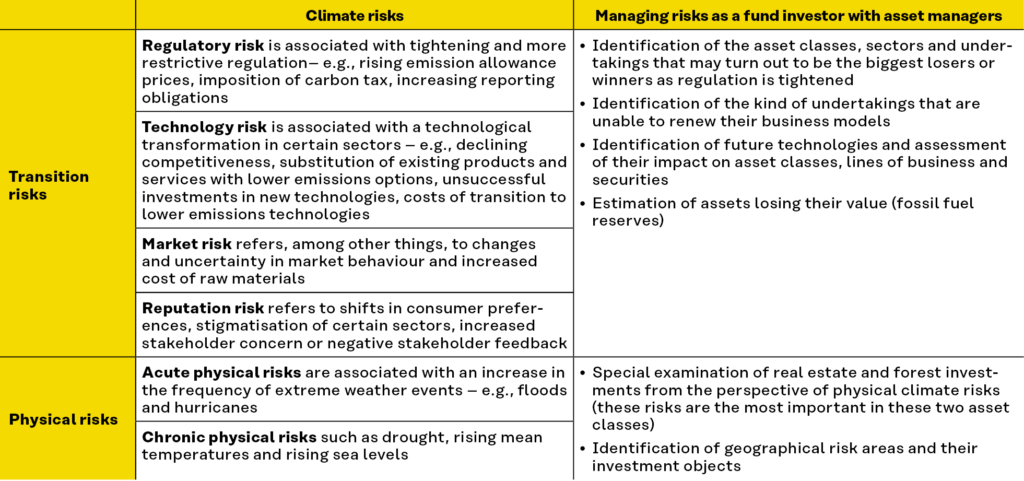

According to the TCFD definition, the risks posed by climate change are divided into transition risks related to the transition to a low-carbon economy, and physical risks caused by global warming.

Transition risks include, among others, regulatory changes, technological developments, market behaviour and reputational risks.

Physical risks are divided further into acute and chronic risks. Furthermore, the investment opportunities brought about by climate change are related to, for example, companies that develop technologies for climate change mitigation or solutions that facilitate the transition to a low-carbon economy.

Climate risks and climate opportunities have financial implications, the identification of which may lead to changes in strategic allocation or investment strategy, potential divestments and dialogue with asset managers and companies.

The economic impacts of the climate risks may include, for example, production and operational disturbances, supply chain disturbances, loss of asset values, physical damages, an increase in insurance premiums, and changes in resource and production prices and consumption behaviour. Figure 1 shows the risk framework in accordance with the TCFD model and the risk management perspectives regarding Sitra’s investments.

Risks can also be assessed by examining the climate targets set by companies themselves. Companies that have set targets in accordance with the Science Based Targets initiative can be considered to be aligned with the Paris Agreement. Moreover, a lack of ambition in target-setting leads to an increase of long-term risks.

Objectives and action plan

Sitra supports the global transition to carbon neutrality through the selection of investment targets and engagement. The long-term objective is that all Sitra’s investments are aligned with the Paris Agreement. Furthermore, Sitra aims to achieve a carbon-neutral investment portfolio by 2035, provided that the investment environment makes it possible. Sitra’s goal is in line with Finland’s national target.

In accordance with the Act on Sitra, all investments are made in a secure and profitable manner. Therefore, the transition to a low-carbon and ultimately carbon-neutral investment portfolio will also be implemented in a controlled manner.

Sitra aims to achieve a carbon-neutral investment portfolio by 2035.

The mitigation of climate change requires an increase in the use of sustainable and renewable forms of energy, as well as phasing out fossil fuels. Other tools include, for example, saving energy, increasing energy efficiency, circular economy, electrification of transport, halting deforestation, increasing natural carbon sinks, and promoting climate-resilient food production and consumption.

This means assessing the relationship between the return on and risks associated with an investment from the perspective of climate risk and reducing the share of high-risk companies or sectors – or even excluding them altogether from Sitra’s investment universe – and increasing the share of investments that create climate solutions.

Sitra aims for a carbon neutral investment portfolio without emissions compensation. In the real economy, contributions to emissions reductions are made at the company level, which is why Sitra has reservations about the use of compensations in investment activities. The compensation options are limited, and their use should be reserved for activities in which other methods of emissions reductions are not possible due to technological or economic reasons.

Performing a climate analysis on an investment portfolio requires access to high-quality data. Sitra uses Investment Research Finland’s ESG reports, which are based on MSCI data. At the moment, the carbon risk can be calculated for around 60% of the total value of Sitra’s investment portfolio.

The aim is to increase data coverage by adding new asset classes to the scope of calculations and to expanding the set of key indicators. Sitra’s investment portfolio is reviewed at least once a year, and the climate report is prepared based on this data.

The climate impacts and climate risk of Sitra’s investments are measured using the carbon footprint. Sitra’s long-term goal is to achieve a carbon-neutral investment portfolio. In the short term, the aim is to significantly reduce the carbon intensity of Sitra’s investment portfolio. The progress is monitored in relation to a benchmark index: the carbon intensity of Sitra’s investments must remain below the index. The goal is to ensure that the carbon intensity of Sitra’s investments is at least 50% lower in 2025 than in the base year 2020. The corresponding target for 2030 is 75%.

When examining the carbon footprint and carbon intensity, account will be taken of emissions arising directly from a company’s own operations (scope 1) and indirect emissions related to the use of purchased energy (scope 2). As the calculation methods and data evolve, the goal is also to take all indirect emissions (scope 3) into account.

Climate risks can be reduced by focusing on companies with a small carbon footprint or low carbon intensity in relation to the rest of the sector. Moreover, climate risks can also be reduced by, for example, investing in renewable energy or other environmentally beneficial business.

Sitra aims for a carbon neutral investment portfolio without emissions compensation.

An important means for investors in mitigating climate change is funding so-called climate solutions. Funding climate solutions refer to investments that provide solutions enabling emission reductions and take the progress of climate change into account in their activities. Therefore, climate solutions play a part in both mitigating climate change and adapting to it. The definition will be specified further, and a target will be set for the share of climate solutions in Sitra’s portfolio at the latest in 2023.

Sitra has excluded from its investment universe any companies with more than 30% of their turnover linked to coal production or use of coal in power generation without a clear strategy to reduce use of coal. Moreover, the development of other potential carbon risk concentrations is also monitored, including the amount of fossil fuel reserves.

For investors, the pledges made by companies to reduce emissions in relation to the targets of international climate agreements are an indication of positive development. The development of the investment portfolio and alignment with the goals of the Paris Agreement are monitored on a fund-level and through dialogue with the asset managers.

Investors may also seek ways to influence companies and asset managers. Especially major investors have the power to influence companies and asset managers. In fact, institutional investors are among the strongest drivers of responsible investment activities. By building networks, smaller investors can also increase influence over their investments.

Sitra has excluded from its investment universe any companies with more than 30% of their turnover linked to coal production or use of coal in power generation without a clear strategy to reduce use of coal.

Sitra makes its investments through funds. This highlights the significance of investor networks, as direct contacts with companies are rare. For example, Sitra holds engagement discussions only with asset managers.

Sitra’s engagement efforts also include participation in investor initiatives. One example of these is the Climate Action 100+ initiative, which encourages companies to achieve emissions reduction targets in line with the Paris Agreement and to report on the risks posed by climate change to their business activities.

Figure 2 shows Sitra’s investment road map to carbon neutrality. The carbon neutrality target has guided the development of Sitra’s investment portfolio since 2021. Additional milestones have been set for 2023–2030, and their contents and schedules are specified regularly as the knowledge base improves.

Over the past 15 years, Sitra has been making climate-friendly investments, for example, in thematic equity funds and private equity funds, in renewable energy investments in infrastructure funds, real estate funds with energy efficiency goals, and in growth companies developing climate-friendly technologies. Thus, in practice, measures aimed at building a more climate-friendly investment portfolio were already initiated well before the drafting of Sitra’s climate strategy.

Risks related to the implementation of the strategy

The climate strategy must be built upon an uncertain future, and it is not possible to plan its implementation in great detail.

The definitions related to climate indicators and carbon neutrality remain ambiguous, and they may yet change significantly. Although the coverage of climate data has continuously improved, there is still uncertainty associated with the reliability of the data.

Only a limited proportion of the activities of Sitra’s underlying fund holdings take place in Finland and therefore fall within the scope of the national carbon neutrality target. Most of the carbon neutrality targets in place elsewhere in the world have been set for later years (2040–2060) or they have not yet been set at all. Therefore, in 2035, the selection of carbon-neutral investment opportunities is still likely to remain limited, and some sectors that are essential for the functioning of the society may be excluded from Sitra’s investment universe.

As a fund investor, Sitra cannot influence the selection of underlying fund holdings. The investment strategies of most investment funds are unlikely to fully meet Sitra’s climate strategy for investments, leading to a risk that targets that are incompatible with the climate strategy end up in the investment portfolio. Moreover, due to delays in reporting, Sitra does not have a continuous, updated view of its underlying fund holdings.

Reducing the carbon footprint too suddenly may lead to increased investment risks. This can happen, for example, through reduced diversification or wrong timing.

Sitra’s goal is to support the transition to a low-carbon society, which also requires making investments in companies whose carbon footprint is currently high. Consequently, investing in these companies that support the green transition may also occasionally increase the carbon footprint of Sitra’s investment portfolio.