Climate impact

Danes living in urban areas cycle 2.8 km per day Norway is a world leader in replacing conventional cars with EVs. At the end of 2015, 2.6% of private cars in Norway were electric vehicles (EVs) and 0.5% plug-in hybrid vehicles (PHEVs). In 2015, 17% of newly registered cars were EVs and 5.3% PHEVs.

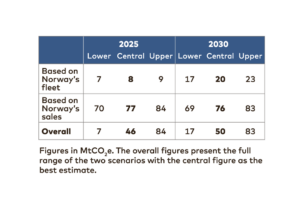

We have considered two cases in which OECD countries, Brazil and China emulate the Norwegian achievement. In the first case, other countries achieve Norway’s 2015 share of vehicles in their car fleet by 2030. The second case is based on other countries achieving and retaining Norway’s 2015 share of vehicles in new sales from 2018 to 2030.

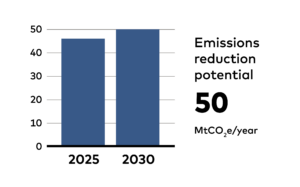

The global abatement potential in 2030 is approximately 50 Mt. The emission reduction is relatively small as countries are expected to increase the share of EVs significantly already in the baseline scenario.

Success factors

In Norway, EVs are exempt from car registration taxes, value added tax (VAT), road tolls and parking fees in public spaces. The annual registration fee is heavily reduced and EVs may use public transport lanes. Charging stations have also been built in most urban areas, as well as between the largest cities.

In 2015, the vehicle tax based on CO2 emissions was reduced also for PHEVs. This has resulted in a large increase in the sale of PHEVs.

“More than 1/5 of new cars sold in Norway are already electric or plug-in vehicles.”

Costs

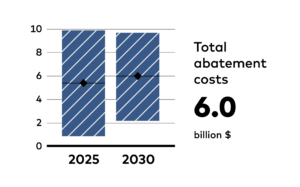

We estimate EVs and PHEVs to have abatement costs of 135 and 28 $/tCO2, respectively. The figures do not include the capital costs of charging infrastructure.

Co-benefits

EVs and, to a lesser extent, PHEVs provide multiple co-benefits, such as

- cutting harmful air pollution

- reducing fuel imports

- cutting fuel bills

- reducing noise

Barriers and drivers

EVs in Norway are essentially zero-emission cars as the electricity mix in Norway contains almost no fossil fuels. However, EVs cut emissions also in many countries with high shares of coal power. We also see a general trend towards decarbonisation of power production.

EVs are more economical in markets where electricity is relatively cheap and gas and diesel relatively expensive, such as the Nordic countries. In countries where this is not the case, additional measures may be required, such as removing subsidies on fossil fuels.

As most Nordic countries have high taxes for cars, tax exemptions provide a significant incentive. Countries with lower taxes would need to apply other incentives. For instance, in Germany, car buyers receive $4,500 when they choose an electric vehicle, with the cost shared 50–50 between public funds and car manufacturers.

Both buying new EVs and building the necessary charging infrastructure entail relatively high capital costs. Although some of the costs will be offset by reductions in fuel use and increasing co-benefits, at current prices EVs are affordable mostly in wealthier countries. New and more affordable models as well as domestic manufacturers in countries like India may change the picture, however.

RELATED SOLUTIONS