Impact investing means investments made in companies, organisations or funds that intend to generate a measurable, beneficial social or environmental impact along with a financial return. A loan agreement with impact objectives included in its terms and conditions serves as a simple example of such a measure. At the other extreme, we find Social Impact Bonds (SIB), which strongly bind the public sector, investors and service providers in terms of impact objective as well as of risk and profit.

The Finnish National Impact Investing Advisory Board (NAB) began its work in its new composition in mid-June. It is tasked with steering and supporting the development of the operating environment and the markets within the field in Finland.

“Impact investing has all the prerequisites for being a part of the future financing solutions for a welfare state. The objective of the steering group is to promote this development, as well as the launch of various forms of impact investing in the Finnish financing markets,” says Henri Grundstén, Development Director of Finnish Industry Investment Ltd, who acts as chairman of the National Advisory Board.

The members of the National Advisory Board are Jenni Airaksinen (Director of research and development, Association of Finnish Local and Regional Authorities), Teri Heilala (CEO, FIM), Olli-Pekka Heinonen (Director General, Finnish National Agency for Education), Anni Huhtala (Director General, VATT Institute for Economic Research), Hille Hyytiä (Managing Director, Motiva Ltd), Terhi Kilpi (Deputy Director General, National Institute for Health and Welfare), Kimmo Lipponen (CEO, ARVO ry, Finnish Association for Social Enterprises), Juha Majanen (Deputy head of Budget Department, Ministry of Finance of Finland), Pekka Samuelsson (Investment Director, Taaleri), Jukka Vähäpesola (Head of Equities, Elo Mutual Pension Insurance Company) and Sami Tuhkanen (Vice President, Endowment Capital, Sitra). Mika Pyykkö, Project Director of Impact Investing at Sitra, acts as secretary of the NAB. The two-year term of the previous steering group ended in December last year.

Impact investments reflect the values of investors

Impact investing is a kind of umbrella concept. From the perspective of investors and in their language, it deals with impact investments that can be seen as the most advanced form of responsible investing, as they consist of active measures aimed at also achieving measurable social or environmental benefits. Globally, impact investing is often connected to the promotion of the UN’s Sustainable Development Goals.

A recent study conducted by the Global Impact Investing Network (GIIN) describes the rapid growth of this multidimensional market. The assets classified as impact investments managed by the investment services organisations that responded to the annual survey doubled in 2017, amounting to approximately 228 billion US dollars (Annual Impact Investor Survey 2018).

In Finland, impact investing attracts a lot of interest, but the market is still small and rather unorganised. This is revealed by a study (“The opportunities of venture capital investment in impact investing”) by the Finnish Venture Capital Association (FVCA), Sitra and Deloitte, published a year ago.

The institutional investors interviewed for the study, however, were of the opinion that venture capital investments already include a lot of hidden effectiveness that is not necessarily recognised or acknowledged, and that should be made visible.

“It is clear that impact investing will become a permanent part of financing markets. As part of responsible investment policies, for example, institutional investors will require increasing amounts of impact reporting from their targets of investments,” Grundstén stresses.

Finland is also an active operator in the international communities within the field, such as the Global Steering Group for Impact Investment (GSG). The new National Advisory Board continues this co-operation. The GSG group, which originally came into being within the G8 network of leading industrial nations, is chaired by Sir Ronald Cohen, who is known as the father of both venture capital and social investing. He is scheduled to visit Finland in August.

For companies and organisations, the impact perspective opens up new opportunities for obtaining capital and financing, as well as assignments. To turn it into a competitive advantage, though, they are required to verify the impacts of their own operations and to be capable of communicating them to various stakeholders.

Sitra brought social impact investing to Finland – to support sustainable welfare

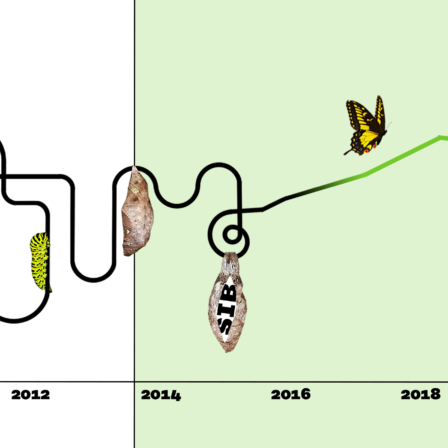

Sitra has been building an operating environment for impact investing in Finland for about four years. The focus of the work is on Social Impact Bonds.

“For the public sector, SIB agreements enable making financially risk-free focused investments in welfare, which is particularly valuable with a view to promotional and preventive activities. In Finland, with the help of SIBs, we can increase welfare in the long run, enhance the use of tax revenues and narrow the sustainability gap,” says Sitra’s Mika Pyykkö.

An SIB consisting of seven performance-based funding agreements is being introduced in Finland. Last summer, the Ministry of Economic Affairs and Employment announced an Integration SIB with the aim of employing 2,500 refugees and immigrants during the next three years. The funding raised for the SIB amounts to 14.2 million euros, making it the biggest SIB in Europe in terms of capital. The next SIB to be launched in autumn is the Children SIB, aimed at promoting the welfare of children, young people and families with children, with FIM acting as fund manager.

Further information:

Henri Grundstén, Development Director, Finnish Industry Investment Ltd (Tesi)

henri.grundsten@tesi.fi, tel. +358 50 431 0840

Mika Pyykkö, Project Director, Impact Investing, Sitra

mika.pyykko@sitra.fi, tel. +358 294 618 259

Taru Keltanen, Specialist, Communications, Sitra

taru.keltanen@sitra.fi, tel. +358 40 674 3246

Recommended

Have some more.