Competition is increasing and client demands are changing. These changes are driving companies to develop new business and operating models, strategies, and partnerships that enable them to adapt faster to continuously evolving market conditions. Business ecosystems are one solution to this problem, as they offer a new, more flexible way of organising with different kinds of partners, allowing companies to access more capabilities and enabling them to scale faster. Asymmetric partners in particular are therefore encouraged to form partnerships, as different sized companies have their own strengths, but also weaknesses that can be complemented by a partner’s capabilities. Asymmetric partners mean that partners that have differences with their resource portfolios and market positions collaborate.

There are already tens if not hundreds of ecosystems involving Finnish companies. Many lessons can be learned from these existing ecosystems concerning their structures, purposes and the industries that have already started to utilise this means of joint value creation. This working paper provides valuable information on these topics, as it collates key findings from a study on the collaboration between large companies and small and medium sized enterprises (SMEs) in business ecosystems formed around data sharing between partners. The research findings show that it is beneficial for asymmetric partners to collaborate and share data, as it allows them strategic opportunities and operational benefits.

1. Changing competitive situation driving companies to create ecosystems

Constantly changing client demands and operational environment are driving companies to shift away from traditional business models and to choose to utilise business ecosystem models instead. Business ecosystems can create many strategic opportunities and operational benefits for large companies and for SMEs. Within ecosystems, companies can share data with each other and form new business opportunities.

Companies must co-evolve over their own boundaries. Client demands are continually changing, and companies need tools to survive the constantly increasing competition (Prakas & Deshmukh, 2010). Companies from most sectors have moved from competing on efficiency and effectiveness to competing on continuous innovation, and they have noticed it is increasingly difficult to do so alone. Instead, they must co-evolve over their own boundaries as no single company, regardless of its size, has all the required knowledge and resources for this change. (Moore, 2006.) Therefore, companies have been turning to new business models and have replaced hierarchically managed value chains within ecosystem models, that are more modular and decentralised by design (Still, Lähteenmäki & Seppänen, 2019).

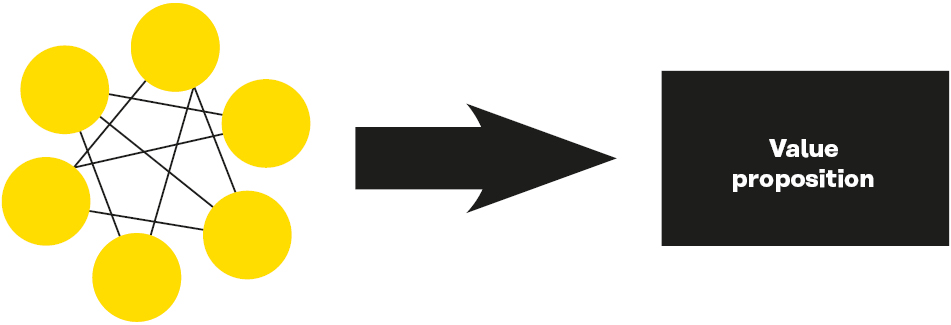

What are business ecosystems? Business ecosystems are economic communities that are supported by foundation of interacting organisations and individuals that are usually created around platforms. (Bosch-Sijtsema & Bosch, 2015). Ecosystems include different sets of actors, such as companies, organisations, and individuals. The central idea of ecosystems is that these actors or so-called participants aim jointly to bring value to clients. (Rinkkala et al., 2019.) This is illustrated by Figure 1.

Figure 1. Ecosystem members aim jointly to bring value to customers together.

Ecosystem participants are involved in the delivery of a specific product or service through competition and cooperation. The main idea is that parties in ecosystems affect each other constantly, creating evolving relationships in which each party must be flexible and adaptable to survive. (Hayes, 2019.) Companies can operate in multiple ecosystems at the same time and have different roles in them. In ecosystems, companies must strike a balance between power and symbiosis and apply a collaborative approach for innovating and a competitive approach for complement building. (Bosch-Sijtsema & Bosch, 2015.) Business ecosystems can offer many kinds of benefits and possibilities for the parties included, such as external strategic opportunities. External strategic opportunities mean that companies can exploit business opportunities beyond their own boundaries, usually with the help of a third party (Huttunen et al., 2019). Strategic opportunities can be created, for example, by sharing data with partners within ecosystem (Huttunen, 2019).

Data is a company resource. Companies already possess a lot of data, which is typically planned to be used to meet their own needs. But companies should consider data as a resource that can be shared it with other companies, because it differs from other resources like capital or human resources, as it can be multiplied and shared with others without losing its value (Seppälä, et al., 2019; Levitin & Redman, 1998.) Already by 2019, about 49% of Finnish companies considered data as a resource, and the number of companies using new technologies and models enabling data sharing is estimated to grow by 2.4% annually (Huttunen et al., 2019). Data is important because it can help companies to move on to new industries or ecosystems and find alternative choices for traditional competitive landscapes (Woerner & Wixom, 2015). A company must make a strategic decision on whether to keep or share the data that it has. The data that a company does not use might be valuable for other companies. If the data is a “waste” for a company, which means that it is not of interest to the company from an economic perspective, it could be offered to other companies, even free of charge (Seppälä et al., 2019.)

Two dimensions of benefits created with data: strategic and operational. Benefits gained from using data in business can be categorised into two dimensions: strategic opportunities and operational efficiencies (Huttunen, 2019). Strategic opportunities refer to how data can be used to create incremental innovations or better customer targeting, or other opportunities that will generate more revenue for a company (Davenport & Kudyba, 2016; McAfee & Brynjolfsson, 2012). According to Reko Lehti (2020), data can also be used to make a company as a preferred partner in an ecosystem, especially if the company is offering a data set that another party has become accustomed to. Operational efficiencies include cost savings and reduced manual work (Mukhopadhyay, Kekre & Kalathur, 1995).

Companies should therefore share data with each other, as obtaining new data allows them to compare and augment their internal data with that from external sources, leading to even more accurate and better results (Dawes, 1996, 378–379). It can also increase productivity and help build tighter business relationships, help design better products and allow a company to gain more revenue (Dawes, 1996; Huttunen et al., 2019b). The technical benefits of data sharing include helping avoid duplicate data collection, processing, and storage. So, sharing data can save resources, increase productivity, and reduce overall costs. (Dawes, 1996.) Data is a resource that can be used for solving problems, and consequently more data may allow more comprehensive problem solving with more accurate information (Dawes, 1996).

Asymmetric partners help each other overcome challenges. Large companies especially should share their data and collaborate with smaller partners, as it would be of mutual benefit (Sing, Braid, Mathiassen, 2018). Large firms have opportunities to use economy of scale, as they have better resources and often possess larger datasets and networks, but their weakness is that they usually lack organisational flexibility. In the other hand, SMEs usually have high specificity in technical skills, organisational flexibility, and the capability for faster reaction to changing market situations, but they might not have the necessarily skills to manage larger innovation processes and they might lack resources. (Jang et al., 2016.) Therefore, asymmetric partners can gain benefits from data sharing and collaborating in business ecosystems.

2. Business ecosystems require strategic thinking from companies

What decisions does a company need to make if it wants to co-create an ecosystem or join an existing one? There are many strategic and operational decisions to be made. A company should plan carefully how to include its partners into the value creation process and to decide on the role it wants to assume within the ecosystem.

Companies should create joint value in ecosystems. To make an ecosystem benefit all participants, a company can no longer concentrate only on innovating by itself, though it is essential to also consider how to help others to create value. Many times, companies entering in ecosystems have done it by broadening their own value proposition by combining their core offering with some previously unrelated product or service. (Jacobides, 2019.) This can mean, for example, that partners start to offer some jointly produced services for their clients.

Companies should select a role to play within an ecosystem. The companies included within an ecosystem have different roles, some more central than others. Sometimes it is better to be a complementor or to share the role of orchestrator with another company than being the actual orchestrator. Orchestrators aim to increase the productivity of the ecosystem and in general to develop it by providing assets, and by connecting participants. Complementors participate in the ecosystems, even creating value, but they do not guide ecosystems as orchestrators. Being the orchestrator of an ecosystem usually requires having a superior product or service that is difficult to replicate. (Iansiti & Levien, 2004; Jacobides, 2019.)

Companies should understand what value they can bring to an ecosystem. The role a company possesses within an ecosystem effects the innovation process of it (Iansiti & Levien, 2004). Therefore, it is also important to understand what value-creating role the company has in the ecosystem. These roles are data source, service provider, operator, and end user. Data sources provide data for ecosystem partners. Service providers offer data-based services to end users. Operators offer a data system or other infrastructure services for ecosystem members, such as identity or consent management or logging services. End users use the products and services provided by ecosystem members. (Sitra, 2019.) Each of these roles has an impact on the ecosystem and therefore each role is important.

Some operate in multiple ecosystems. Even if a company plans to co-create a new ecosystem with its partners, it is beneficial to participate in another ecosystems as well, to gain experience, to learn about the needs of client and complementors and build skills that are required. (Jacobides, 2019.) Some companies are orchestrators of many ecosystems, such as the tech giant Alibaba, which started from the wholesale marketplace and currently is taking part in a C2C marketplace (1688.com), a third-party-seller B2C ecosystem (Taobao) and in sales and marketing platform (Juhuasuan). Often, these kinds of large successful companies start from one market and then shift or expand to others. Many complementary companies choose to “multihome”, which means that they participate in many ecosystems, to gain benefits of cross-ecosystem client reach. (Jacobides, 2019.) However, it was found that a large company might not always be the ecosystem orchestrator, as small companies too can act in this role. In fact, the study shows that some larger companies had made a strategic decision not to pursue this role, allowing them to focus on their core competencies while still gaining benefits from participating in an ecosystem. Therefore, a company also must decide on how many ecosystems it will, and more importantly can, participate in.

3. What ecosystems already exist in Finland?

There are already dozens if not hundreds of business ecosystems operating in Finland. These existing ecosystems offer valuable insights for study, such as why ecosystems have been created and what industries have already utilised them. The study found that there are multiple different types of ecosystems, that their structures and sizes vary considerably, and that they are used for solving different kinds of problems.

The study identified 32 existing ecosystems. Some of these ecosystems were Finnish, some were international ecosystems involving Finnish companies. These ecosystems were identified by using secondary sources and interviewing experts specialised in business ecosystems. However, the list is not comprehensive, as there are ecosystems other than those listed in Appendix 1.

Multiple ways to form ecosystems. The study showed that ecosystems have different structures and that larger companies in particular have already started to utilise this business model. Some of the ecosystems had only private companies, some of them involved public organisations like universities, and some even had individuals (developers). Most of the ecosystems were found to have mostly large partners; none consisted only of smaller companies. About half of the ecosystems had at least one smaller partner, which indicates that different sized companies can bring value to business ecosystems.

“Ecosystem is a real word and network is a real word, but how data centric they are, varies a lot.”

(CEO of data economy start-up)

The types, structures and legal forms of the ecosystems varied greatly. Some ecosystems were governed through foundations, some through companies, and others were projects. The data centricity of the ecosystem also varied, depending on its purpose. Some of the ecosystems offered services for mutual clients, some had some an ideological purpose (such as creating a more sustainable environment), some of them only aimed at helping partners with their development processes (for example by including artificial intelligence and machine learning into their business) or by offering assets (such as data), services or solutions to the partners. From this it can be seen that ecosystems can offer solutions for the manifold needs of companies and clients. The size of the ecosystem also varied. Some had ten partners, others had hundreds of partners. Sixteen out of thirty-two of the ecosystems had announced publicly that they were open for any partners, and only one said it was a closed ecosystem. Many of the ecosystems did not say if they are open or closed.

Certain industries already utilise the ecosystem model. The ecosystems identified were relatively young, the oldest was launched in 2015. It was found that some sectors already utilise ecosystem business models more often than others. Sectors in which ecosystems were found most were environment, health, finance, mobility, and energy. Those sectors where ecosystems were found are specified in Table 2 below.

Ecosystems will be open in the future. Only three cross-industry ecosystems were found to be operating at the moment, but according to Kari Uusitalo and Petri Laine, who were interviewed, it is believed that cross-industry ecosystems will become more common in the future, as ecosystems are believed to open themselves to any willing actor. The underlying reason for this is that open ecosystems are allowing participants to utilise more diverse sets of data, as data can be gained from different sectors, which opens up more extensive opportunities to create innovative business concepts and new disruptive services. In addition, it allows participants to answer diverse client needs better. Therefore, it is recommended that this is kept in mind when building technical interfaces to ecosystems so that these interfaces could be opened in the future for any willing participant. (Uusitalo & Laine, 2020; Uusitalo & Laine, 2020b.)

List of sectors where business ecosystems were found:

- Build-up environment

- Construction

- Cross industry

- Environment

- Finance

- Health

- Housing market

- HVAC

- Logistics

- Manufacturing

- Maritime

- Metallurgical

- Mobility

- Teaching

- Travel

4. What can be learned from others?

Company representatives from three ecosystems were interviewed to provide insights into why real-life ecosystems have been created and what good practices can be learned from them. One ecosystem operated in the financial sector, another in mobility. The third, a manufacturing ecosystem, was still at a startup phase when the interview took place.

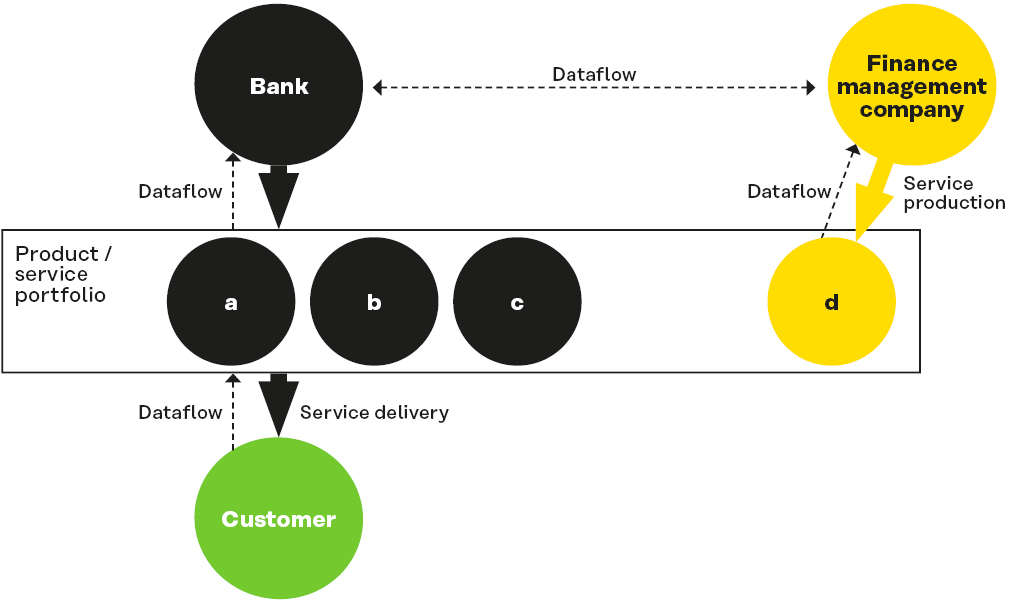

CASE 1 ecosystem “Small through Large” consists of a small finance management company, a large bank and their third partner, which is not presented further in this paper. All the partners share data with each other, but mostly it is the bank that shares data from its large datasets to the smaller partner finance management company, so that the company can provide a service for joint clients in B2B sector, as shown by Figure 2.

Figure 2. A large bank shares its data with a smaller partner finance management company, to enable them to provide a service for their joint clients.

All the partners in this financial ecosystem benefit from collaboration and data sharing. Through the ecosystem the bank does not need to develop or directly provide financial management services by themselves but can still offer these services to its clients via the ecosystem. Also, both partners obtain new clients from each other. The smaller partner is the orchestrator, but all the partners are included in developing the ecosystem. The bank merely participates in it, but it has gained some benefits that usually orchestrator possess, related to the branding of an offered service, because its brand is well known.

“We started to build a partnership. Later the ecosystem and data sharing has become partnership by-product or an enabler and implementer of the partnership.” (Bank)

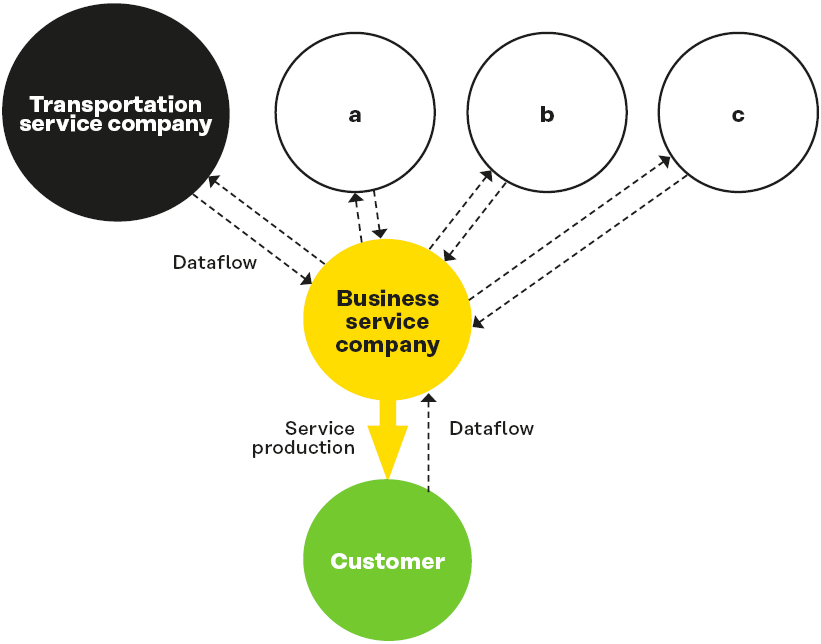

CASE 2 ecosystem “Hub-and-spoke” consists of the company offering small business services offering, its larger partner, which offers transportation services, and many other partners that are not further mentioned in this paper. Some of the companies within the ecosystem are mutual competitors, but each of these companies only collaborates and shares data with the smaller business service company. In other words, each of the companies included in this ecosystem have a two-way relationship with the business service company, as shown in Figure 3.

Figure 3. Business service company uses larger partners data to provide digital services for partner’s clients.

The business service company provides digital services and digital access to B2C clients of the larger partners’ physical services. The transportation company shares its data with the business service company, to allow this smaller partner to provide digital services for the transportation service company’s clients. The large transportation company benefits from this collaborative relationship, as its own services can be more easily accessed by clients and the ecosystem provides an opportunity to keep up with the industry’s development. The smaller company benefits, as without this data they would not have a service.

“Without data and sharing of data we would not have our service at all.”

(Business service company).

In this ecosystem the smaller partner is also the orchestrator and the larger partner is the participant. Business service company collects data from all the ecosystem members and compiles reports, which are given to all participants so that each ecosystem actor can adapt better into changing market situations and improve its own deliverables, as this benefits the whole ecosystem.

CASE 3 ecosystem “Enabler” offers a slightly different perspective, as the ecosystem is still at its emergent phase. The ecosystem includes a bank, a manufacturing company, and a technical enabler organization, a security system provider company and a project leader company. The aim of the ecosystem is to automate the supply chain of financing trading between the manufacturing company and its clients. This requires data sharing between the trading partners, their banks and the freight companies that handle the delivery of products.

The bank is involved in this project because it wishes to move the industry forward with payment versus delivery model, where payment is not done with billing, but instead financial products are included within the process. Bank is also aiming to stay up with the current development called “Business 4.0” which includes that data and information is included within the business model. All the partners within ecosystem benefit, as automatisation would improve processes and allow each partner to gain more accurate information in real-time.

Key findings from cases

These cases presented give three different perspectives for ecosystems. However, the different contained overlapping themes, so we can formulate the key findings in general terms, as follows:

Ecosystems require time. The creation phase of ecosystems only lasted about six months, but it took longer to make the ecosystem productive. All the companies were satisfied with the collaboration itself, even though some of them had still to reach their financial targets. The cases indicated that the longer an ecosystem had been operating, the better its financial results. This indicates that business ecosystems require long-term thinking by their participants.

Client consent is key for data sharing in ecosystems. How the data was used dictated what data was shared with partners. The sectors within which companies operate also place limitations concerning data. For example, banking secrecy places clear limitations on data handling and usage for partners. However, all the companies said that the General Data Protection Regulation (GDPR) sets basic rules on how the data is shared, handled, and used. However, the GDPR was seen positive, as it gave clear rules for data sharing. Client consent were highly important as it was seen to be key for data sharing between partners within an ecosystem.

Shared data requires business or client related justification. Both, raw and refined qualitative data was shared among partners. Companies from Case 1 and Case 2 shared client behaviour data, as it was used to improve the client experience. In addition to client data, some business-related data was also shared to improve business processes. According to one company, basically any data could be shared, it would just require some business or client related justifications. Also, it appeared that these days people are more willing to share their data than they have been before, as they gain services in return. This means that there is more data available for use than ever before. The costs of data sharing were covered with data monetisation. Data monetisation means that the intangible value of data is converted into real value by selling it or converting it into other tangible benefits or by avoiding costs. (Najjar & Kettinger, 2013, p. 213–214). The costs of data and data sharing with partners was paid for by the clients, as costs were integrated within service fees.

Partners of all sizes can benefit from using and sharing data. Data sharing with partners was seen to create strategic and operational benefits for all the companies interviewed. All those involved in operating ecosystems said that they have gained new revenue streams and more satisfied clients by collaborating with ecosystem participants and sharing data with them. Partners from one of the ecosystems said the benefits also included reduced risks and costs. Also, one of the smaller companies offered an innovative service based on the shared data, which suggests that data sharing can in fact generate innovations.

“Collaboration is strength and above all the future lies in collaboration.” (Transportation company)

It was also stressed that the understanding of clients and the ability to adapt to changing market situations improved, as there was more information available. For example, one of the companies interviewed said they would not have managed the COVID-19 crisis as well as they have now without the existing ecosystem and its data sharing. In addition, the perceived benefits were that companies understood each other better because they shared data, and this facilitated better collaboration. Among the benefits that larger companies identified as resulting from the collaboration is their ability to build a softer brand image, and that such collaboration could bring about more these types of collaborative relationships in the future with smaller partners. Another large company also said that it is gaining visibility from the collaboration and that this has helped them keep up with the developments in the sector. A smaller company said that collaboration with a larger partner was beneficial in that larger partner’s strong brand affected its own brand and strengthened it.

“The speed of development is one of the main issues in this kind of collaboration. The growth company like us can rapidly create new services, be innovative, and make different solutions much more agile than a giant can do in the market.”

(Financial management company)

People are behind it all. Individuals are seen as having a highly important role in the creation of the ecosystems and making them successful. These individuals have been pushing this change through within their own organisations, which has not been easy as some companies have initially had very traditional approaches. The personal chemistry among people within the companies and the close dialogue between partners were also seen as very important.

Given best practices for co-creating ecosystem. It was said that the most important things to consider when co-creating an ecosystem is to have the right team, set clear common goal for the ecosystem, keep technical tools as open as possible, and to set standards. It was also considered important to remain open-minded in collaboration, and to be honest about what can be done and what cannot be done. It was also thought important to have a visionary attitude towards the future and to try out new things, as hypothesising alone does not say what works and what does not.

5. Lessons learned

Companies should co-create ecosystems or join existing ones, as ecosystems can bring benefits to companies of all sizes, and particularly to their clients. Business ecosystems can bring in new revenue streams for companies, help them create innovations, and satisfy their clients. Also, both SMEs and large companies can reduce their costs and risks and improve their brands by using ecosystems.

1. Companies should co-create ecosystems or join existing ones. Ecosystems bring benefits to companies of all sizes. They can help companies to gain new revenue streams, create innovations, and improve client experiences. It can also help companies to reduce their risks and costs and keep up with developments in their industry. According to Reko Lehti (2020), it is often easier to join an existing ecosystem than to set one up yourself. Also, the technical interfaces of ecosystems should be built with the idea in mind that in the future they could be opened up to all willing participants.

2. Large companies should share their data with smaller companies. Sharing data can help larger companies to focus on their core competencies, while still enabling them to adapt to changing market situations. This is because partnering with smaller partner can engender more flexibility and scope to innovate. It can also give new and better services to clients whose needs are changing rapidly.

3. Costs of data and data sharing can be covered without ruling out potential smaller partners. The costs of data and data sharing can be included for example in the service fees that clients pay. Also, if data does not have any economic significance for a company, it could be offered to others, even free of charge. This way the costs of data do not have to rule out potential smaller partners that do not have sizeable financial resources.

4. Companies should learn from existing ecosystems. Learning from existing ecosystems can help companies to avoid possible pitfalls. It is recommended that companies should participate in multiple ecosystems to gain experience. It can be beneficial not always take the role of orchestrator within an ecosystem, even a large company can act as a participant and still gain many benefits from the ecosystem.

5. Ecosystems extend across borders. Digitalisation has globalised competition. Ecosystems should be considered at international and not national level.

6. Companies do not collaborate, people do. Even though ecosystems bring companies together, the individuals in them are the ones who bring value. Individuals are driving change and collaborating, and so personal chemistry and identifying the key role of individuals are paramount.

Summary

The operational environment is constantly changing as competition has become more aggressive, client demands are continually changing, and many industries have moved from competing on efficiency to competing on innovations. Companies consequently have to adapt rapidly to these changes and, above all, be willing to change themselves. Business ecosystems are one potential solution to this problem, as they are modular and structurally decentralised and therefore offer flexibility and the ability to react quicker to changing situations (Still, Lähteenmäki & Seppänen, 2019).

Business ecosystems are economic communities that are usually built around platforms (Bosch-Sijtsema & Bosch, 2015). They comprise companies, organisations, and individuals. The central idea of ecosystems is that these actors aim to bring joint value to client (Rinkkala et al., 2019). Business ecosystems create many strategic opportunities and bring many operational benefits for the companies in them. If companies want to co-create an ecosystem or join an existing one, there are many strategic decisions that they need to make. For example, companies need to consider what role they want to take from the ecosystem, and how they will include partners into the value creation process.

The ecosystems were studied as part of a master’s thesis project conducted in spring and summer 2020. The key findings of this research are presented in this working paper, as the study offers much valuable information about real-life ecosystems. Companies from three different ecosystems were subsequently examined in-depth, based on interviews, so as to gain an understanding of co-creating and operating in an ecosystem. Research showed that both large and smaller partners benefit from collaborating and sharing data with each other in a business ecosystem. The benefits identified include new revenue streams and more satisfied clients. Using and sharing data helped companies to adapt to upheavals in the market and allowed partners to improve their own competitive position. Also, collaborating had a positive impact on companies’ brands, decreased costs and reduced risks. During the research, the challenges were found to be on the operational side of the collaborative relationship. For example, in one ecosystem the differences between the sizes and structures of the partners sometimes posed a challenge. Also, with another of the ecosystems the financial targets had not yet been met, but the partners were positive that they would be in the future. Overall, all the ecosystem participants interviewed were pleased with collaborating with their partners.

From the findings we can conclude that companies should co-create ecosystems or join existing ones because it benefits them. Large companies should share their data with smaller companies, as it helps them to concentrate on their core competencies and gives them flexibility to adapt into changing market situations. Costs of data sharing can be covered without ruling out potential smaller partners, which includes covering the costs with service fees paid by clients. Companies should learn from existing ecosystems and the limits of ecosystems span across borders as competition is global. One of the key findings was that companies do not collaborate but that people do instead.

Tiivistelmä

Toimintaympäristö muuttuu kaiken aikaa, koska kilpailusta on tullut aiempaa aggressiivisempaa, asiakkaiden vaatimukset muuttuvat jatkuvasti ja monet alat ovat siirtyneet kilpailemaan innovaatioilla tehokkuuden sijasta. Yrityksiltä edellytetään sopeutumis- ja uudistumiskyvykkyyttä alati muuttuvassa toimintaympäristössä. Liiketoiminnalliset ekosysteemit ovat yksi ratkaisu tähän ongelmaan, sillä ne ovat modulaarisia ja hajanaisia rakenteiltaan, mikä mahdollistaa joustavuuden ja nopeamman reagointikyvyn muuttuviin tilanteisiin (Still, Lähteenmäki & Seppänen, 2019).

Liiketoiminnalliset ekosysteemit ovat taloudellisia yhteisöjä, jotka yleensä rakentuvat alustojen ympärille (Bosch-Sijtsema & Bosch, 2015). Ekosysteemeihin kuuluu monia toimijoita, kuten yrityksiä, organisaatioita sekä yksilöitä. Ekosysteemien päätavoitteena on tuottaa arvoa asiakkaille (Rinkkala et al., 2019). Liiketoiminnalliset ekosysteemit voivat tuoda yritykselle paljon sekä strategisia mahdollisuuksia että operatiivisia hyötyjä. Mikäli yritys haluaa perustaa ekosysteemin tai liittyä olemassa olevaan ekosysteemiin, sen täytyy tehdä monia strategisia päätöksiä. Yritysten tulee esimerkiksi harkita, minkä roolin he ottavat ekosysteemissä ja kuinka he osallistavat kumppaninsa arvontuotantoon.

Ekosysteemejä tutkittiin osana pro gradu -projektia, joka toteutettiin vuoden 2020 kevään ja kesän aikana. Tutkimuksessa pureuduttiin yritysten toimintaan kolmessa eri ekosysteemissä. Syvähaastattelujen avulla saatiin arvokasta tietoa olemassa olevien ekosysteemien toiminnasta ja niiden perustamisesta. Haastatteluista ilmeni, että sekä isot että pienet yritykset hyötyvät yhteistyöstä ja datan jakamisesta liiketoiminnallisissa ekosysteemeissä. Hyötyihin lukeutuivat esimerkiksi uudet tulovirrat ja aiempaa tyytyväisemmät asiakkaat. Datan jakaminen kumppanien kesken antoi myös yrityksille työkaluja parantaa omaa toimintaansa. Lisäksi yhteistyöllä nähtiin olevan positiivinen vaikutus yritysten brändiin. Joissakin tapauksissa yhteistyö vähensi yritysten riskinoton tarvetta ja kuluja. Tutkimuksen aikana löydettyjen haasteiden todettiin koskettavan toimintaa kumppanien välillä. Esimerkiksi yhdessä ekosysteemissä haasteita asetti ajoittain jäsenten välinen koko ja rakenne-erot. Lisäksi toisessa ekosysteemissä taloudellisia tavoitteita ei vielä ollut saavutettu, mutta toimijat uskoivat, että ne on mahdollista saavuttaa tulevaisuudessa. Kaikki haastatellut ekosysteemin jäsenet olivat erittäin tyytyväisiä ekosysteemiin ja yhteistyöhön kumppaneidensa kanssa.

Tuloksista voidaan todeta, että yritysten on kannattavaa luoda ekosysteemeitä tai liittyä olemassa oleviin ekosysteemeihin. Suurten yritysten tulisi jakaa dataansa pienemmille toimijoille, sillä se auttaa isoja yrityksiä keskittymään ydinosaamiseensa ja helpottaa mukautumista muuttuviin markkinatilanteisiin. Datan jakamisen kustannukset voidaan kuitata lisäämällä kustannusten hinta asiakkaan maksamiin palvelumaksuihin. Näin ollen myös pienempiä potentiaalisia kumppaneita voidaan ottaa mukaan ekosysteemeihin. Yritysten tulisi myös oppia jo olemassa olevien ekosysteemien kokemuksista ja ottaa niistä esimerkkiä. Lisäksi on tärkeä tunnistaa, että ekosysteemit eivät tunne maiden rajoja, sillä kilpailu on kansainvälistä. Yksi tärkeimmistä löydöksistä oli, että yritykset eivät tee yhteistyötä, vaan ihmiset tekevät.

Sammanfattning

Företagens verksamhetsförutsättningar förändras konstant i och med att konkurrensen blivit alltid aggressivare, kundernas krav förändras hela tiden och många branscher har övergått till att konkurrera med innovationer i stället för med effektivitet. I en föränderlig värld krävs det att företag uppvisar anpassnings- och förnyelseförmåga. Ekosystem för företag är en lösning på detta problem genom att ekosystemens strukturer är modulära och decentraliserade, något som medger flexibilitet och snabbare reaktionsförmåga på föränderliga situationer (Still, Lähteenmäki & Seppänen 2019).

Företagsekosystem är ekonomiska gemenskaper som vanligtvis byggs upp kring plattformar (Bosch-Sijtsema & Bosch, 2015). Dessa ekosystem inkluderar många aktörer, till exempel företag, organisationer och individer. Ekosystemens huvudsakliga mål är att skapa värde åt kunderna (Rinkkala m.fl. 2019). Företagsekosystem kan ge ett företag många strategiska och operativa fördelar. Om ett företag vill skapa ett nytt eller ansluta sig till ett befintligt ekosystem, måste det fatta en mängd strategiska beslut. Exempelvis måste företaget överväga vilken roll det vill ta i ekosystemet och hur det ska inkludera sina partner i värdeproduktionen.

Sådana här ekosystem har undersökts inom ett pro gradu-projekt som utfördes våren och sommaren 2020. I undersökningen utforskades verksamheten bland företagen i tre ekosystem. Djupintervjuer gav värdefull information om hur befintliga ekosystem fungerar och hur de skapats. Av intervjuerna framgick att såväl stora som små företag drar nytta av samarbetet och av att dela data inom ekosystemet. Fördelarna inkluderade exempelvis nya inkomstflöden och nöjdare kunder. Datadelningen mellan partnerna gav även företagen verktyg för att förbättra sin egen verksamhet. Dessutom ansågs samarbetet ha positiva effekter på företagens varumärken. I vissa fall minskade företagens utgifter och behov av risktagande. De utmaningar som observerades medan undersökningen pågick konstaterades gälla deltagarnas inbördes verksamhet. I ett av ekosystemen gav till exempel storleks- och strukturskillnader mellan deltagarna tidvis upphov till utmaningar. I ett annat ekosystem hade de ekonomiska målen inte ännu uppnåtts, men aktörerna trodde att de kan uppnås i framtiden. Alla ekosystemdeltagare som intervjuades var mycket nöjda med sina ekosystem och med samarbetet med partnerna.

Utifrån resultaten kan man konstatera att det lönar sig för företag att skapa nya eller ansluta sig till befintliga ekosystem. Stora företag bör dela med sig av sina data till mindre aktörer, eftersom det hjälper de stora företagen att fokusera på sin kärnkompetens och underlättar anpassningen till föränderliga marknadssituationer. Kostnaderna för datadelning kan kompenseras genom att priset läggs till de serviceavgifter som kunderna betalar. På så sätt kan också potentiella mindre partner inkluderas i ekosystemen. Företagen bör vidare dra lärdomar av erfarenheterna i befintliga ekosystem och följa dessa ekosystems exempel. Dessutom är det viktigt att vara medveten om att ekosystem inte håller sig till landsgränser, eftersom konkurrensen är internationell. Ett av undersökningens viktigaste fynd var att det inte är företag, utan människor, som samarbetar.

References

Adner, R., 2016. Ecosystem as Structure. Journal of Management, 43(1), pp.39–58.

Agarwal, R., Selen, W. 2009. Dynamic Capability Building in Service Value Networks for Achieving Service Innovation. Journal compilation C 2009, Decision Sciences Institute. pp. 431–475.

Awake.AI. 2020. Smart port and shipping ecosystem.

Barbel, M., Meier, O., Soparnot, R., 2000. Asymmetric alliances between SMEs and large firms in the area of innovation: strategic determinants and cultural effects. Dans gestion 2000 2014/6 (Volume 31), pp. 87–106.

BatCircle. 2020. BatCircle.

Bosch-Sijtsema, P., Bosch, J., 2015. Plays nice with others? Multiple ecosystems, various roles and divergent engagement models. Technology Analysis & Strategic Management, 27(8), pp.960–974.

Business Finland. 2018. Combi works provides industrial production as a service.

Business Finland. 2018b. Silo.AI kehittää tekoälyn ekosysteemiä kasvumoottorirahoituksella.

Business Finland. 2018c. Avaruusteknologia-alan kasvumoottori tarjoaa maapallon kuvantamisdataa innovaatioiden alustaksi.

Business Finland. 2018b. Griffin Refineries.

Business Finland. 2018e. Muovijätteiden jalostamisen kasvumoottori yhdistää globaalin kysynnän ja suomalaisen tarjonnan.

Business Finland. 2018f. Meri luo uusia kasvumoottoreita.

Business Finland. 2019. Kasvumoottori awake.ai tehostaa satamien toimintaa tekoälyn avulla.

Business Finland. 2019b. Kasvumoottori kirittää logistiikka-alan tuottavuusloikkaan.

Business Finland. 2019c. Muovien kierrätyksen ja biopohjaisten materiaalien kehittämiseen verkosto rakenteilla.

Business Finland. 2019d. Sisäilman laadun kasvumoottori iaqe tavoittelee tervettä sisäilmaa.

CleverHealth Network. 2020.

Clic Innovation Oy. 2020. 4 Recycling.

Combi Works. 2020. What we do.

Combient. 2020. Moving faster together.

Combient. 2020b. Spark.

Combient. 2020c. Foundry.

Combient. 2020d. Mix.

Combient. 2020e. Collegial.

Compensate. 2020. For Business.

Corda. 2020. Open-source blockchain platform for business.

Corda. 2020b. Partner program.

Davenport, T. H., Kudyba, S. 2016. Designing and Developing Analytics-Based Data Products. MIT Sloan Management Review. Vol. 58, No. 1. pp. 83–89.

Dawes, S. 1996. Interagency information sharing: Expected benefits, manageable risks. Journal of Policy Analysis and Management, 15(3), pp.377–394.

Dias. 2020. Asuntokauppa on nyt digitaalinen.

Dias. 2020b. DIAS tulee sanoista digitaalinen asuntokauppa.

DIMECC, 2020.

Flexens. 2020. The company. Building Skills and knowledge – backed by world leading organizations.

Gaia. 2020. Winning Offshore Wind Concept In the Baltic Sea.

Griffin Refineries. 2020. Producing raw materials, fuels and energy from waste.

Hayes, A. 2019. Business Ecosystem. Investopedia.

Hemilä, J. 2020. Welcome to KEKO Blossoming Building Ecosystem. Keko.

Huttunen, H. 2019. The role of data in firm performance: A techno-economic view. Master’s Thesis. pp. 1–84.

Huttunen, H. Seppälä, T. Lähteenmäki, I., Mattila, J., 2019. What Are the Benefits of Data Sharing? Uniting Supply Chain and Platform Economy Perspectives. SSRN Electronic Journal.

IAEQ. 2020. Indoor Air Quality Ecosystem.

Iansiti, M., Levien, R. 2004. Strategy as Ecology. Harvard Business Review.

ICEYE. 2018. ICEYE Receives 10M€ Capital Loan from Business Finland To Initiate Internet of Locations.

ICEYE. 2020. Solutions.

Intelligent Indstry. 2020b. Turning digital into practical.

Jacobides, M. G. 2019. In the Ecosystem Economy, What’s Your Strategy? Harward Business Review.

Jang, H., Lee, K., Yoon, B. 2016. development of an open innovation model for R&D collaboration between large firms and small-medium enterprises (SMEs) in manufacturing industries. international journal of innovation management, 21(01), pp.1–26.

Levitin, A. V., Redman, T. C. 1998. Data as a Resource: Properties, Implications, and Prescriptions. Sloan Management Review; Fall. pp. 89–101.

Kyyti. 2018. Smart mobility ecosystem (PDF). Business Finland.

Kyyti. 2020. Kyyti Maas Platform.

Marco Polo. 2020. Solutions.

McAfee, A., Brynjolfsson, E. 2012. Big Data: The Management Revolution. Harvard Business Review.

Moore, J., 2006. Business Ecosystems and the View from the Firm. The Antitrust Bulletin, 51(1), pp.31–75

Mukhopadhyay, T., Kekre, S., Kalathur, S. 1995. Business Value of Information Technology: A Study of Electronic Data Interchange. MIS Quarterly, 19(2), pp.137

Najjar, M., Kettinger, W. 2013. Data Monetization: Lessons from a Retailer’s Journey. MIS Quarterly Executive. pp, 213–225.

Nordea. 2017. Nordea Takes Open Banking Beyond PSD2.

Nordea. 2020. The future of banking APIs within the Nordics.

Nordea. 2020b. API Products.

One Sea. 2019. European space agency to partner with one sea alliance on maritime digitalisation and autonomous shipping initiatives.

OP. 2017. OP Developer – future business in APIs

OP. 2020. Our APIs go beyond banking.

Open Ecosystem Network. 2020. One Sea Autonomous Maritime Ecosystem.

Open Ecosystem Network. 2020b. Our Network.

Pidun, U., Reever, M., Scüssler, M. 2019. Do You Need a Business Ecosystem? BCG.

Platform of Trust. 2020.

Prakash, A., Deshmukh, S. G. 2010. Horizontal Collaboration in Flexible Supply Chains: A Simulation Study. Journal of Studies on Manufacturing (Vol.1-2010/Iss.1). pp. 54–58

Rabelo, R., Bernus, P. 2015. A Holistic Model of Building Innovation Ecosystems. IFAC-PapersOnLine, 48(3), pp.2250–2257.

Rinkkala, M., Launonen, P., Weckström, N., Koponen, P. 2019. Internationally significant innovation and growth ecosystems in Finland. Spinverse Oy.

Seppälä, T., Hakanen, E., Lähteenmäki, I., Mattila, J., Niemi, R. 2019. The Resource Dependency of Data: A Prospective on Data Sharing in Supply Chains. SSRN Electronic Journal.

Silo.AI. 2020. AI for people.

Singh, R., Baird, A., Mathiassen, L. 2018. Collaboration risk management in IT-enabled asymmetric partnerships: Evidence from telestroke networks. Information and Organization, 28(4), pp.170–191.

Sitra. 2019. Rulebook for fair data economy – rulebook template for data networks.

Sjöstedt, T. Pääkaupunkiseudun Smart & Clean -säätiön verkkosivut.

Smart & Clean. 2020. Solutions for 1,5 C world.

Smart & Clean. 2020b. A world-class reference area.

SmartRail Ecosystem. 2020b. Ecosystem Phases.

SmartRail Ecosystem. 2020c. Co-Activities.

Still, K., Lähteenmäki, I., Seppänen, M. 2019. Innovation Relationships in the Emergence of Fintech Ecosystems. Proceedings of the 52nd Hawaii International Conference on System Sciences. Hicss. pp. 6367–6376.

Trans Digi. 2020. “VTT ja Lapin yliopisto kehittävät tulevaisuuden liikkumisen alustaa”.

Una Oy. 2020.

University of Oulu. 2020. Amet Alustatalous metallijalostuksessa.

Uusitalo, K,. Laine, P., 2020. Interview 6.8.2020.

Uusitalo, K., Laine, P. 2020b. Testbed simulation modelling in an open business ecosystem context – benchmarking logistics network performance LRN2018 SI invited paper. International Journal of Logistics Research and Applications. pp. 1–22.

Vantaa. 2020. DigiOne.

Vastuu Group. 2020d. We make your life easier.

Vastuu Group. 2020. Building the future.

Vastuu Group. 2020b. Partner programme.

Vastuu Group. 2020c. Partnerimme.

Vendiafi. 2020. Vendiafi – five years of mobility service pioneering.

VTT. 2018. CaaS-ekosysteemi sujuvoittamaan tavaralogistiikkaa.

VTT. 2020. Seitsemän johtavaa suomalaisyritystä luo yhdessä ekosysteemin kiinteistödatan hyödyntämiseksi.

VTT. 2020. Seven leading Finnish companies join forces to co-create an ecosystem for smart building data.

Whim. 2020. All transportation in one app.

Woerner, S., Wixom, B. 2015. Big Data: Extending the Business Strategy Toolbox. Journal of Information Technology, 30(1), pp.60–62.

Recommended

Have some more.