Foreword

Quantum technology is expected to revolutionise many industries in the coming years. The implications of quantum computing for cybersecurity, medicine, and materials science, among others, make it a strategic technology. Quantum computers could break the traditional encryption used in everyday electronic transactions and communications, and quantum sensors have the potential to revolutionise cancer screening.

Global competition is accelerating as several countries seek to advance their position as a forerunner in quantum technology. Growing tensions between autocratic countries, such as China, and democratic countries and regions, such as US and the EU, have prompted governments to heavily invest in quantum technologies, also to avoid dependencies and to increase resilience.

Finland has decades of experience in quantum research and development, and leading companies in key areas of the quantum supply chain. In addition, Finland is home to the most powerful supercomputer in Europe, LUMI, which serves as a critical enabler for practical applications of quantum computing.

A shortage of skilled labour is a well-known bottleneck for the quantum industry. Now geopolitics, even security policy, has entered the picture and we need to be aware of it. Finland operates in the context of the EU, but we are also now a member of NATO, which has its own interests in quantum technologies. Finland could, over time, develop a large industrial ecosystem around quantum technology and the industries that use it. Alternatively, Finland could also lose its best companies and experts to countries that are strategically investing in this critical technology.

This paper aims to provide an overview of the quantum policy landscape and policy recommendations for Finland, taking into account this evolving geopolitical environment. It also aims to stimulate a debate among stakeholders on how to develop the quantum policy landscape in Finland. For Finland to realise the strategic potential of quantum technology, it will be crucial to understand its strengths and the hard truths of international competition.

The paper, written by an independent author, is based on research into the strategies of key countries and economic areas, as well as interviews with several companies, agencies, civil servants, and experts in the field. We would like to thank all those who contributed to this work. In particular, we would like to thank the author, Andrea G. Rodríguez, for her expertise and dedication to the work. We hope that the recommendations will help to move the discussion forward so that Finland’s quantum ecosystem can reach its full potential.

5.5.2024

Kristo Lehtonen and Satu Salminen

Kristo Lehtonen is Director and Satu Salminen Specialist of the Fair Data Economy theme at Sitra

Summary

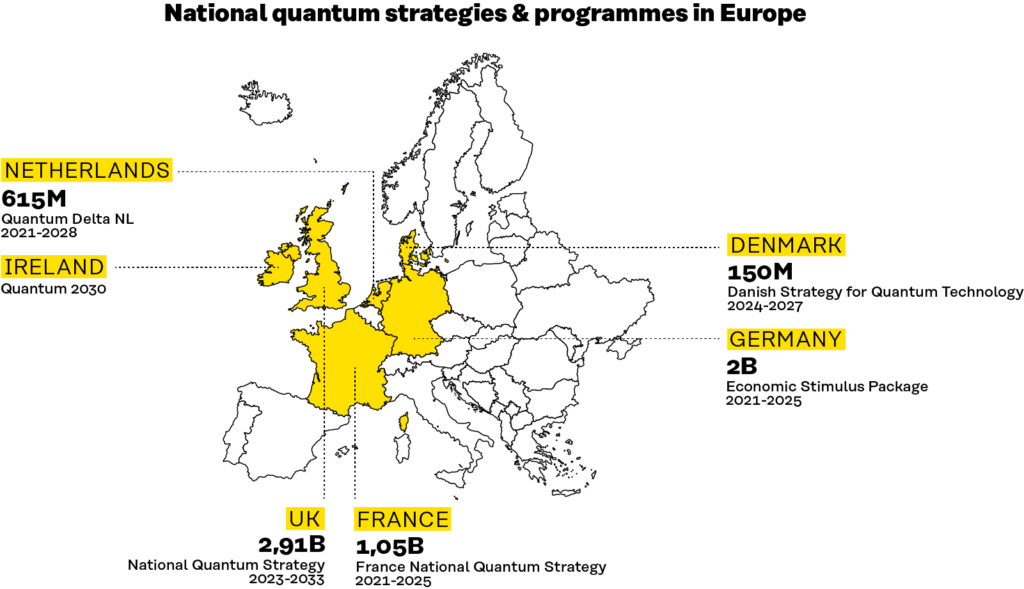

Quantum computing has significant geopolitical and geoeconomic implications for society, the economy and national security. With major international players such as China and the US are racing to develop advanced quantum capabilities, the EU launched a Quantum Flagship programme in 2018 to ensure long-term investment in quantum technologies. Additionally, many EU member states have launched national programmes in quantum technologies, with only five having fully developed national quantum strategies as of March 2024 (Denmark, France, Germany, Ireland, and the Netherlands). Public investment figures in quantum technologies vary. Denmark has pledged to invest €150 million, France €1,05 billion, Germany €2 billion, and the Netherlands €615 million. Ireland has not publicly disclosed its budget for quantum technologies research and innovation yet.

As the quantum computing landscape evolves and new trends emerge, such as quantum computing as a service (QCaas) and hybrid quantum-classical interfaces, Finland can be at the forefront of the quantum race, taking advantage of its unique academic-industry-government networks, research excellence, and its existing advanced high-performance computing networks. Well-known Finnish stakeholders, such as IQM and Bluefors, are already a crucial part of European quantum computing supply chains. However, strategic challenges loom, such as geopolitical uncertainties and divergent positions on international partnerships in the EU and NATO contexts.

To strengthen the thriving quantum computing ecosystem in Finland with leading companies and research, Finland must recognise the strategic importance of quantum technologies, develop a national quantum strategy, and unite efforts to coordinate funding, fill supply chain gaps, and promote the adoption of quantum computing. Failure to act strategically may lead to losing key players to countries with established strategies and long-standing support for the quantum industry. Better coordination and understanding of the industry landscape in the EU context will be critical for Finland to be successful in the quantum era.

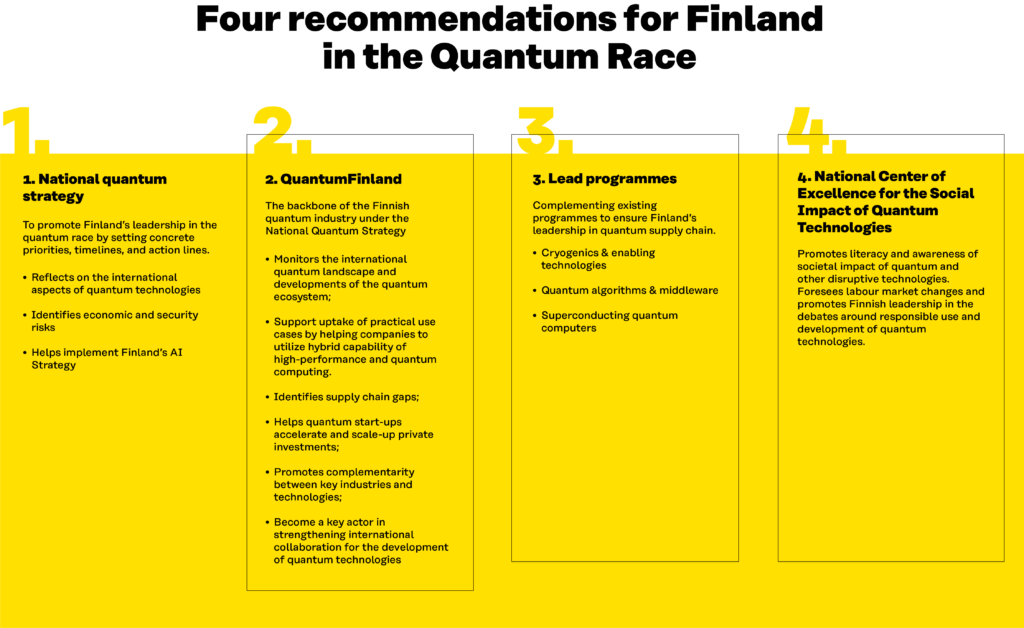

Recommendations for Finland ‘s quantum advantage:

- Create a National Quantum Strategy for Finland in 2024. Engage all key stakeholders to ensure a collaborative approach between all actors.

- Support Finland’s industrial policy goals in quantum technology by establishing a collaborative structure of existing actors in Finland. This joint initiative, QuantumFinland, would systematically monitor developments in the quantum industry, identify supply chain gaps, help companies to attract and scale up private investment, promote complementarity between key industries and technologies, and support the uptake of practical use cases.

- Complement existing programmes with targeted lead investment programmes into cryogenics and enabling technologies, quantum algorithms and middleware, and superconducting hardware to advance Finland’s lead in key areas of quantum computing supply chains.

- Establish a National Centre of Excellence for the Societal Impact of Quantum Technologies to improve Finland’s foresight capabilities and promote the responsible development and use of quantum technologies.

Introduction

In today’s rapidly changing world, advanced technologies have become an indispensable factor in driving progress, innovation, and development. Quantum computing, a new computing paradigm that exploits quantum mechanics, has the potential to revolutionise the economy, improve industrial processes and help policymakers solve complex challenges. However, quantum and other deep technologies have acquired profound geopolitical significance due to their transformative potential and their dual-use applications. The impact of quantum technologies on cybersecurity, particularly encryption, materials science or medicine has contributed to the perception of quantum computing as a strategic technology, offering substantial advantages to countries with advanced capabilities in shaping global markets, the international technology landscape, and securing critical infrastructure.

Traditional geopolitical rivalries are becoming intertwined with economic power. The US and China are investing enormous sums to lead the quantum race. If Europe falls behind in this technology race, it could not only lose its competitive edge but also develop new critical dependencies (Bradford 2023). In addition, because of the disruptive effect of quantum computing in areas such as information security, lack of investment and competitive edge on quantum technologies could create additional national security risks (G. Rodríguez 2023).

As a result, countries are increasingly advancing their strategic interests on the global stage by using their economic power to seek not just influence but dominance. This phenomenon, driven by a complex interplay of factors, is disrupting trade dynamics, investment flows, supply chains, and technological development.

International players such as the US, Canada, China, and Russia are speeding up their efforts to build quantum computers, quantum sensors, and quantum networks. In Europe, efforts are spearheaded by the European Commission and particularly EU member states that have put forward dedicated funding schemes and, a handful of them, national quantum strategies as described in Chapter 3.

On 28 November 2023, NATO allies approved the alliance’s quantum strategy, which reflects their importance for peace and security. However, NATO does not have its own capabilities and nations are responsible for developing them (Article 3, North Atlantic Treaty). Therefore, while the strategy can help NATO coordinate priorities, it is up to the countries to implement it.

Just as Silicon Valley developed through decades policies that enabled a rich innovation ecosystem to prosper, the EU and its member states could develop an ecosystem of their own with the right long-term policy framework, contributing to strategic autonomy and to the long-term prosperity of the continent. Finland already has world-leading expertise in many areas of quantum technology. With the right policy mix and investment, it can develop world-leading capabilities, build up a competitive quantum commercial industry, and aim for leadership in critical areas of the quantum technology supply chains. However, there is also a risk that Finland will lose its promising position if its key companies and experts gradually relocate or are acquired abroad.

The potential market size of quantum technologies by 2040 is estimated to be around €106 billion. Of these technologies, quantum computing has the potential to add around €1 trillion to the global economy by 2035 just for its impact across four key industries: chemicals, life sciences, finance, and automotive. (McKinsey 2023.) Countries that understand the strategic value of quantum computing will profit from a first-mover advantage, with positive economic and diplomatic spillovers.

This paper looks at the emerging trends in the global quantum landscape, such as hybrid classical-quantum interfaces and quantum computing as a service, explores Europe’s quantum policy and Finland’s position in more depth and finally concludes with policy recommendations for Finland. How can Finland improve resilience, increase productivity, and benefit from the market potential of quantum computing? How can it use its diplomatic power to promote its interests in quantum technologies?

1. Emerging trends in the global quantum computing landscape

Quantum computing uses quantum mechanics to process data and perform operations on it in a new way. Instead of being an evolution of classical computers—that is, advanced Turing machines— it represents a paradigm shift, requiring the development of new hardware and software. Whereas classical computers process information in series of 0 and 1 (bits), quantum computers fill the whole mathematical space with all possible states using the superposition principle. Superposition means that a quantum system can exist in multiple states simultaneously until it is measured or observed. Thus “instead of processing sequentially bit by bit, quantum computers calculate in parallel on the numerous states assumed simultaneously by the quantum variables” (Jaeger 2018). In sum: computing power increases exponentially opening the door to new applications and advantageous innovations affecting current industries: from the automobile to material science, from health to artificial intelligence (AI).

However, there are major challenges in developing a fault-tolerant quantum computer. Scientists are currently experimenting with different quantum computing architectures (trapped ions, superconducting circuits, spin qubits, photonic networks, neutral atoms, Majorana fermions, etc.). However, among these architectures, superconducting computers developed by companies such as IQM, are gaining momentum.

Experimentation with different architectures is influenced by the need to create architectures that can reduce the interference or noise that can break quantum states and promote the scalability of entangled qubits (which is at the basis of future quantum computing power). In addition, these architectural experiments help find real-life applications that can shape the new market and ensure an influx of private investment in quantum computing.

As science advances, so does the innovation around how to create quantum computers, which has an impact on how countries strategically think about creating relevant policies to promote scientific development with industrial applications. Understanding market trends, such as hybrid interfaces and access to quantum computing through the cloud, can be a good starting point for countries to develop targeted investment programmes.

Hybrid classical-quantum interfaces

Hybrid classical-quantum interfaces allow quantum computers to work in harmony with classical supercomputers (high-performance computers, HPC). High-performance computing allows data to be transferred to the quantum processor, control the system, and perform measurements, but the quantum computer does the calculations. Hybrid interfaces complement quantum computers by supporting them and enabling their use in applications where they could truly be useful, without waiting for large quantum computers to be developed, and by allowing quantum computers to interact with classical environments—current networks and information systems. It also allows SMEs to benefit from quantum computing by providing access through the HPC network.

Current quantum computers cannot compete with classical computers as it takes hundreds of functioning qubits combined with a low error rate to gain an advantage, and there are still questions about whether quantum computers will be able to take over the classical supercomputing market at all. However, as the field develops, hybrid classic-quantum interfaces are useful for understanding future quantum applications and exploring how current technological development can interact and complement developments in the quantum field to create commercial benefits in a much shorter timeframe.

Because of the more immediate use cases of hybrid classical-quantum interfaces, industry players are also supporting hybridisation. In Europe, players such as Qilimanjaro and IQM Finland are developing products that can be used seamlessly in high-performance computing environments. QuantumMachines in Israel is focusing on interoperable structures that can interact with classical environments. In the US, NVIDIA is developing solutions to accelerate hybrid interfaces with software solutions such as cuQuantum or new platforms such as QODA, and IBM is going one step further and has recently signed an agreement with the universities of Tokyo and Chicago to experiment with new hybrid architectures (IBM Newsroom 2023).

Europe has an advanced network of supercomputers, distributed across the continent, to support research and innovation. In 2018, the European Union created the European High-Performance Computing Joint Undertaking (EuroHPC JU) with the mission to develop, deploy and expand Europe’s supercomputing network. Since then, the EuroHPC has procured nine supercomputers and in 2023 signed a hosting agreement for quantum computers in six EuroHPC sites, one of them in Ostrava belonging to the LUMI consortium.

These computers will be available to academic researchers and industry players in Europe through the existing EuroHPC networks. LUMI, as the most powerful supercomputer in Europe (EuroHPC JU 2023), is well positioned to become a point of reference for HPC innovation because of its pan-European base which gives it access to several quantum computers, such as the one that will be inaugurated in Ostrava, but also in Espoo and other sites of the consortium (CSC 2023). This can place Finland at the centre of cutting-edge innovation, with great potential for creating high-value applications based on the use of both quantum and high-performance computing.

As hybrid classical-quantum infrastructures play an increasingly important role in the quantum market, and as hardware for quantum computers develops in different directions, middleware is increasingly becoming an open question for the integration of quantum computers into classical supercomputers. Middleware is software that acts as the glue between both HPC and quantum computers, and makes sure that both systems and devices in the ecosystem, communicate effectively (Boger and Knoll 2023). Middleware sits between the hardware and the algorithms, enabling developers to interact with the heterogeneous hardware (classical and quantum) and focus only on their algorithms. Middleware is also needed to manage the computing resources, which in hybrid interfaces are both classical and quantum and ensure that algorithms work, and that the hardware is used efficiently (Faro et al. 2023).

However, because of the hardware focus of the current quantum computing market, middleware — critical for the integration of quantum computing into HPC — is largely being neglected despite being necessary to control the full stack: from hardware to software. For that reason, large companies that want to provide end-to-end quantum computing, such as IBM, invest in middleware, which reduces the number of middleware players, thus decreasing the pace of innovation needed to ensure access to quantum computers from HPC, and delays adoption.

Quantum-Computing-as-a-Service (QCaaS)

Quantum computers are expensive to build, hard to manipulate, and require a lot of physical space. As the technology advances, the costs of upgrade and maintenance become too high, which impacts scalability. Hence, building on the success of the cloud computing market, companies are increasingly opting to provide quantum computing services throughthe cloud.

Cloud-based quantum computing (or quantum-computing-as-a-service, QCaaS) allows remote access to quantum simulators, emulators, or processors to developers and researchers who want to test their solutions in a quantum environment. QCaaS enables companies to rent quantum computing capacity to experiment and test new products in an advanced computational environment using classical interfaces, which also allows providers test their quantum hardware on real-world applications, widen their client portfolio and close the feedback loop.

Cloud-based quantum computing allows more people to participate in the quantum industry by lowering the cost of entry, both in terms of hardware and skills—no quantum physicists are needed to interact with quantum environments through the cloud.

Though there are many emerging companies in Europe offering QCaaS (for example the Dutch QuantumInspire, Austrian AQT and German T-Systems), Chinese companies such as Alibaba and Baidu and American companies are in the lead thanks to sustained investment in the past decade (see: Table 1). IBM Q Experience allows anyone to remotely access systems with 5 to 16 qubits, Microsoft has created an open ecosystem for external developers to write and run code on the quantum hardware of their choice, or Canada’s D-Wave offers access to quantum annealing solutions that allow companies to improve the optimisation of their services.

In Finland, there are almost no companies (see Table 2) focused on developing a QCaaS offering. This is already delaying innovation in a great number of strategic industries, such as the chemical industry, a key export industry for Finland, and one of the four industries with foreseen biggest impacts from quantum computing (McKinsey 2023). Access to quantum computing resources could maximise R&D investment, for example by allowing researchers to better understand molecular behaviour, thus helping to discover new materials or new active ingredients, or aiding production and transport by using new quantum algorithms to solve optimisation problems (Budde and Volz 2019).

2. Europe’s quantum policy

In 2016, the EU launched a Quantum Manifesto that called on member states and the EU Commission to create a flagship programme to support Europe’s technological edge in quantum technologies. While the programme materialised in 2018, the manifesto also called for EU coordination on the different strategies that could emerge, and it recognised the strategic importance of these technologies for long-term prosperity, competitiveness, and security.

Six years later, the programme has materialised in several ways: research coordination through the Quantum Flagship programme and funding coordination via the QuantERA programme in which non-EU countries such as Israel, Switzerland, Turkey and the UK participate. However, it is precisely the lack of policy coordination that hinders the potential of the EU as a global actor in quantum technologies.

This is partly due to the different perceptions among EU leaders of the benefits of quantum technologies. While some countries, such as France, Germany, or the Netherlands, see it as a national priority, many others still see it as a research and innovation issue and thus place it at a lower level on the political agenda. These different realities lead first-mover countries to accumulate critical resources and services, such as hardware, investment and talent, and only push for conversations at the European level when there is a real risk of technology transfer or when European sovereignty is at stake, which is one of the reasons why quantum technologies have been labelled “strategic” following the publication of the 2023 EU Economic Security Strategy (European Commission 2023b).

Figure 1. Map of the investments in quantum technologies in selected EU countries with quantum strategies. The EU and all its member states combined invest €7,7 billion. Source: National quantum strategies of selected countries.

China is the leading public investor in quantum technologies, although reliable data is hard to come by and the figures contain uncertainties. Only the Chinese National Laboratory for Quantum Information Sciences counts, with €8,5 billion of public investment. These efforts are complemented by several other instruments (total investments estimated to reach €14 billion). After China, the EU and its member states are the second largest public investor in quantum technologies with around €7,7 billion in combined investments.

Still, most private investments are in the US, with a record of about €3 billion invested in quantum technology start-ups at the end of 2022. (McKinsey 2023) While many of the impediments are inherent to the European market (including lack of venture capital market), Europe and its member states can benefit from understanding the current industry landscape and emerging ecosystems to strategically support different segments of the value chain to create industry leaders.

As countries grappled with the need to recover from the economic shock of the Covid-19 pandemic, the Recovery and Resilience Facility (RRF) became an important instrument to mitigate the effects and restructure national economies around the objectives of the twin digital and green transitions. For this reason, the EU Commission set the requirement of a minimum 20% allocation to digitalisation initiatives. The opportunity was therefore ripe for countries to invest in quantum technologies.

While only a few countries had dedicated resources in place for quantum technologies prior to the pandemic, 2021 saw the most quantum programmes and funding initiatives in Europe (see: Table 1). Indeed, available funding played a vital role but so did the increasing awareness of the vulnerabilities of technology supply chains and the effects of disruption of growing geopolitical tensions, as well as the lessons of technological protectionism.

Table 1: Comparison of national quantum strategies in selected countries

| Country | National Strategy | Public funding (€) | Years |

|---|---|---|---|

| China | 14th five-year plan 2021* | ~13,8 billion | 2021-2025 |

| US | National Quantum Initiative, 2018 | 3,4 billion | 2019-2023 |

| UK | National Quantum Strategy, 2023 | 2,91 billion | 2023-2033 |

| Germany | Economic Stimulus Package, 2020 | 2 billion | 2021-2025 |

| France | France National Quantum Strategy, 2022 | 1,05 billion | 2021-2025 |

| Netherlands | Quantum Delta NL, 2019 | 615 million | 2021-2028 |

| Denmark | Danish Strategy for Quantum Technology, 2023 | 150 million | 2024-2027 |

| Ireland | Quantum 2030, 2023 | budget not disclosed | 2023-2030 |

As of March 2024, only five EU countries have fully developed national quantum strategies (Denmark, France, Germany, Ireland, and the Netherlands). Six other countries have established quantum programmes with some degree of government coordination, but they mostly rely on research and academic institutions (Austria, Hungary, Spain, Italy, Latvia, and Slovakia).

At least 16 countries around the world have dedicated public funding for quantum technology development. The funding amounts include the commitments as stated in the given strategies. The figures are expected to rise in the coming years as applications find their way to the market.

As a result, quantum programmes in Europe have in common the need to ensure access to reliable infrastructure and have therefore put the creation of a national quantum computer or companies able to do so at the centre, as well as establishing new educational programmes to fill the labour gap. In addition to this common factor, given the lack of EU coordination, EU countries have increasingly devoted space to the question of international partnerships, which de facto divides member states into groups: internationalist countries and introspective countries.

Internationalist countries see the need to collaborate with other non-EU democratic powers to create technological spheres of influence, particularly when it comes to quantum technologies. Countries such as the Netherlands, and until recently Denmark, are examples of this stream.

Introspective countries, such as France or Germany, prioritise the creation of national synergies between different emerging ecosystems, while placing collaboration at the EU level on a second plane. Collaboration with non-EU countries is sporadic and case-by-case.

The emergence of these two groups raises big questions at the European level and may limit EU action in the long term. Internationalist countries may see restrictions on collaboration as damaging to their own economic security and may veto any decision made in this regard, either in terms of access to EU funding — through public procurement processes, open calls or tenders — and on the diplomatic front through the signing of agreements. This issue is exacerbated by the question of countries that, in the absence of a common EU policy, look at international collaboration within the realm of quantum technologies as a matter of open science and, as in the case of Austria, maintain, strong cooperation links with countries such as China.

3. Finland as a global quantum player

In 2023, the Finnish Quantum Agenda called for the establishment of a national strategy and the creation of a roadmap and targeted developments of the quantum ecosystem. Finland is a globally recognised player in research and innovation and has a dynamic and rapidly evolving quantum technology landscape. Buoyed by a strong tradition of scientific excellence and robust collaboration between world-class academic institutions, industry, and government, Finland has the potential to be on the list of EU frontrunners in quantum technologies and to position itself as one of the Europe’s leading quantum industries with a thriving industrial base and strong export potential.

Finland already has several key players that try to promote Finland’s quantum technology landscape, such as the Technical Research Centre of Finland (VTT), Business Finland with a dedicated quantum campaign and the Finnish Quantum Institute (InstituteQ), including BusinessQ. Currently, Finland has 11 companies working exclusively on quantum-related themes (see: Table 2) in complementary sub-sectors such as quantum software, hardware, and basic components (for example, optics) with two globally recognised actors, IQM and Bluefors, already playing an important role in the configuration of European quantum supply chains (QuantERA 2023). Although the companies differ in size, there are clear synergies to be explored in computing and opportunities in quantum software.

Table 2: Finland’s quantum technologies landscape in a nutshell.

| Company | Area of specialisation |

|---|---|

| SemiQon | Quantum circuits |

| AlgorithmiQ | Quantum algorithms |

| Modulight | Lasers for quantum computers |

| IQM Finland Oy | Superconducting quantum computers |

| Bluefors | Dilution refrigerators |

| Futurice | Cloud-based solutions |

| Quantrolox | Automated qubit control software |

| VTT | Critical communications/quantum computing |

| Unitary Zero Space | Education in quantum computing |

| Vexlum | High-power laser systems |

| Quanscient | Quantum algorithms |

These 11 companies are the result of research excellence and the strengths of the Finnish software and electronics industry. Moreover, most of them are spin-offs from different Finnish, universities which highlights the value and the need to strengthen Finnish academia-industry-government networks, that exist only in small countries. By improving coordination, and creating the necessary policy frameworks, Finland can leverage these strengths to foster the creation of domestic value chains and promote collaboration between complementary industries (including machine learning, software, electronics, optics, cryogenics).

As a European actor, understanding its strengths and weaknesses will also be fundamental for Finland to engage internationally and position itself in the global technology race, as well as to learn how to navigate the increasing uncertainties stemming from the position of neighbouring countries (internationalists vs introspective countries) and the overall geopolitical landscape. Lastly, as a NATO member, Finland has the potential to play a pivotal role in supporting NATO’s technological edge and using its position in the alliance to foster new connections with relevant countries in the quantum industry who are also part of NATO, such as Canada—an emerging global leader in quantum software—and the US, with whom it already signed a joint statement in 2022. NATO’s Defence Innovation Accelerator for North Atlantic (DIANA) recently approved Finland’s proposal to establish an accelerator for start-ups and small and medium-sized enterprises in Finland focused on next-generation communications and quantum technologies. In addition, two test centres will be established: one in Oulu on 6G networks and another one in Otaniemi specialising in quantum technologies, cyber-secure communications, and space technologies (Finnish Government 2024).

Finland ranks among the top 10 of the countries in the world in terms of digital competitiveness, thanks to government support for digital transformation, rapid adoption of digital technologies and promotion of digital skills (IMD 2023). This has facilitated the emergence of a vibrant software community, which is expected to add around €3,5 billion to the Finnish economy in 2025 (Statista 2023). Considering the increasing importance of middleware and software applications to connect quantum computers to classical devices and to help users test and run experiments on quantum hardware, investing in promoting the national quantum software industry can have strong positive effects and help Finland reap the benefits of a potential multi-billion euro market. At the moment, Canada and the US are in the lead position, but Finland already has European market leaders, such as AlgorithmiQ and Quanscient, which—with the right mix of policy direction and investment—already qualify Finland to be the European quantum software champion.

4. Four recommendations from the author to position Finland at the forefront of the quantum race

While Finland’s entrepreneurial culture promotes local collaboration, the county’s top players are already looking abroad. In 2020, IQM opened its first subsidiary company in Munich and continued its international expansion to the US, signing a partnership with UC Berkeley on December 15th, 2023.

Similarly, Bluefors, a spin-off of Aalto University and the main supplier of dilution refrigerators, decided to open an R&D facility in Delft, the Netherlands, a key industrial node of the national Dutch quantum programme launched in 2019. Moreover, in 2023, Bluefors announced the creation of a new Quantum Lab in the Netherlands to further foster synergies with the local Dutch quantum industry.

Although there are already initiatives to stir talent into quantum technologies and build applications (e.g., Quantum Computing Campaign, the Finnish Quantum Flagship and the Finnish Quantum Institute InstituteQ), Finland could benefit from further coordinating efforts and funding, close supply chain gaps, reduce strategic dependencies and promote the adoption of quantum technologies in the country, both at the civil and military levels.

Of the 27 EU member states, only Denmark, France, Germany, Ireland, and the Netherlands have national quantum strategies as of March 2024, and some of them have allocated significant funding and created support schemes which have helped the countries quantum ecosystems to grow, potentially preventing their emerging industry from moving abroad. Finland does not yet have a national strategy or equivalent support schemes, although it has done a lot.

Figure 2: Visualisation of the 4 recommendations to further strengthen Finland’s quantum ecosystem

Recommendation 1: Create a National Quantum Strategy

A National Quantum Strategyshouldreflect on the international aspects of quantum technologies, including the new geo-economic dynamics, and set priorities and timelines to create a sustainable quantum computing ecosystem in Finland, building on the strengths of its mature industries and strengthening its academic-industry-government networks. The goal of the strategy would be to create of a dynamic quantum industry in Finland that integrates and builds on current efforts in the Finnish educational, research, and commercial sectors, and explicitly outlines the supplementary measures needed to achieve this and other strategic goals.

The need for a strategy was already signalled by the Finnish Ministry of Economic Affairs and Employment in 2022. The further deterioration of the geopolitical environment, Finland’s accession to NATO and the effects of increased global competition for talent, companies and investment make it urgent for Finland to have a quantum strategy in 2024, developed in a collaborative approach that engages all relevant stakeholders.

The strategy could include the creation of three important and closely interconnected components: QuantumFinland, a National Centre of Excellence and lead programmes to maintain leadership in vital parts of emerging quantum computing supply chains, the identification and adoption of relevant use cases of quantum technologies and promote economic growth in Finland.

Recommendation 2: Establish QuantumFinland to support industrial efforts

While Finland already has ongoing efforts to boost the local quantum technology industry, stronger coordination is needed to ensure that research excellence is transformed into industry leadership. Closer cooperation between the actors in the Finnish ecosystem will be fundamental to ensuring that Finland has a critical mass of industry leaders to create economies of scale around quantum technologies, while ensuring that funding is invested strategically to meet the needs of the National Quantum Strategy.

For this reason, it would be recommended to establish QuantumFinland to support Finland’s industrial policy objectives. QuantumFinland could be a collaborative structure of the existing actors supporting quantum technologies in Finland. It would monitor the developments in the quantum industry and have a helicopter view of the quantum landscape— both in Finland and abroad. QuantumFinland could build on the achievements of existing initiatives, such as BusinessQ, but would have at its core the creation of a sustainable and dynamic industrial ecosystem that benefits from research excellence. QuantumFinland would, therefore, help accelerate the development of practical use cases with the help of the combination of quantum technologies, high-performance computing, and cloud services (QCaaS).

QuantumFinland would also help identify gaps in the supply chain and help companies to attract and scale up private investments. In addition, it could promote complementarity between key industries and technologies, such as high-performance computing, artificial intelligence, semiconductors, cloud, and green technologies. Lastly, QuantumFinland could become a key factor in strengthening international collaboration in the development of practical quantum applications and services.

Recommendation 3: Ensure investment in lead programmes in cryogenics, quantum software and superconducting quantum computers

In addition, it will be essential to continue investing in Finland’s strengths while diversifying opportunities in the quantum market. To this end, to ensure that Finland has an advanced position in the full stack of quantum computing and is competitive in global markets, it is recommended to complement existing programs with additional lead programmes in cryogenics and enabling technologies, quantum algorithms and middleware, and superconducting quantum computers. These three dedicated lead programmes would not substitute investments on other areas of the quantum value chain and are to be perceived as complementing, and not restricting, existing structures.

Finland, as an attractive location for software companies and as a leader in quantum hardware with companies such as IQM could further cement its advantage in the European market and become a global leader internationally by creating dedicated funding schemes that support innovation in these two tracks. Therefore, these two flagship programmes should identify clear milestones and count on independent funding to ensure long-term gains. Similar initiatives can be found in other countries. The Netherlands, for instance, has a €29 million workstream for quantum sensors and France has dedicated programmes with independent funding on strategic areas (Quantum Priority Research and Equipment Programme, PERP) with a total budget of €150 million.PERP) with a total budget of €150 million.

Recommendation 4: Set up a National Centre of Excellence for the Societal Impact of Quantum Technologies

At the end of 2023, several European countries, including Finland, signed the Quantum Declaration. In it, they committed to creating a network of centres of excellence in quantum technologies. Finland could play its part by establishing the National Centre of Excellence for the Societal Impact of Quantum Technologies to improve its foresight capacity around the impact of quantum technologies. The same centre of excellence could potentially look into other disruptive technologies as well, such as those with dual-use capabilities such as space, 6G, cyber and AI.

This entity, under the National Quantum Strategy, could help Finland lead the debate at the EU level in understanding the societal impact and environment of quantum technologies, including questions around the responsible use and development and also the future of work. As the world adopts and develops quantum technologies it will be fundamental to foresee its impact on the labour market and create appropriate structures that ensure the availability of expertise and talent. The Centre, which should count on independent funding, could be at the centre of these debates and provide policy recommendations to the government and to the European Union to promote quantum literacy, increase the number of experts in quantum technologies, and raise awareness of the societal impact of quantum technologies.

In addition, as the experience with trustworthy AI shows, promoting responsible development from an early stage can have a positive impact on the reputation of Finnish quantum applications, help shape European and global policy, and reduce the costs of adapting to future regulations enforcing fairness. Additionally, Finland would position itself at the forefront of these debates, which could translate into industrial competitive advantage.

5. Conclusion

Quantum computing will be fundamental to realising Finland’s innovation ambitions and managing data flows. It will be a key technology for advanced AI, or the development of 6G networks and virtual worlds. As the field becomes contested, Finland, as well as other European countries, will be faced with the question of how and with whom to collaborate internationally, and how to prevent technology transfer and the acquisition of leading companies. While Finnish companies are already seeking funding outside of Finland, the biggest challenges in technology transfer will not be with democratic allies, where Finland’s position as an internationalist or introspective is still to be defined, but rather with autocratic regimes that can use Finnish innovation to advance their interests.

To this end, consideration of a national quantum strategy should also include measures not only to make of Finland an attractive place for investment and innovation, but also to promote Finland’s strengths and protect Finnish technology from foreign acquisition. The recommendations in this paper aim to support the emergence of a competitive quantum industry in Finland, attract and retain talent, foster international collaboration, promote the responsible development of quantum technologies, and prevent the acquisition of key companies by foreign actors. This measure could make of Finland a testbed of innovative solutions that could potentially be replicated at the European level to meet global demand.

In 2022, Finland was the only European country to feature in the top 10 list of global venture capital/private equity investments in quantum start-ups (McKinsey 2023). This is a clear reflection of Finland’s potential to become a global leader in quantum computing with further coordination and clear public investment that build on the strengths of academia-industry-government networks, research excellence and access to the cutting-edge HPC technology of LUMI.

As international competition intensifies and more European countries join the quantum race, understanding quantum computing as a foundational technology, and signalling the prioritisation of quantum innovation can help Finland attract the necessary talent and have the critical mass to create positive spillovers in its economy while keeping quantum companies within its borders.

The cost of inaction is too high, and the time to be an early mover is coming to an end. As 2024 sees new countries joining the quantum race and new deals and investments in quantum technologies, a national quantum strategy, and even stronger collaboration between key stakeholders, as well as an ambitious industrial policy, are necessary steps to position Finland at the forefront of global quantum race.

References

Bluefors, 2018. Bluefors to Open an R&D Facility on the TU Delft Campus

Bluefors, 2023. Opening Celebration for the Bluefors Lab in Delft

Boger, Y. and Knoll, Y., 2023. What Does it Mean for Quantum Computers to be HPC Ready?

Bradford Anu. 2012. The Brussels Effect: How the European Union rules the World. New York: Oxford University Press.

Budde, F. and Volz, D., 2019. The Next Big Thing? Quantum Computing’s Potential Impact on Chemicals. MicKinsey & Company

Business Finland 2020. Quantum Compting Campaign (Accessed on 16 Janyuary 2024)

CNRS, 2022. The French Quantum national R&D strategy just started (Accessed on 17 January 2024)

CSC, 2023. European & Global HPC landscape – a short overview

DigiChina 2022. Translation the 14th Five-Year Plan for National Informatization – Dec. 2021

European Commission 2023a. European Declaration on Quantum Technologies. (Accessed on 16 January 2024)

European Commission. 2023b. Commission Recommendation of 03 October 2023 on critical technology areas for the EU’s economic security for further risk assessment with Member States. Retrieved 15 January 2024.

European Commission 2023c. Recovery and Resilience Facility. (Accessed 16 January 2024)

EuroHPC JU 2023. Our computers.(Accessed 16 January 2024)

EuroHPC JU 2023. 3 EuroHPC supercomputers make the global top 10 of the world’s most powerful supercomputers.

Faro, I., Sitdikov, I., and Valinas, D. G., Fernandez, F. J., Codella, C., and Glick, J., 2023. “Middleware for Quantum: An orchestration of hybrid quantum-classical systems”. 2023 IEEE International Conference on Quantum Software (QSW) (Accessed 28 December 2023)

Finnish Government, Ministry of Defense press release. Published 14th March 2024.

German Federal Office for Information Security, 2023. Quantum-safe Cryptocraphy.

Government of Ireland, 2023. Quantum 2030 (PDF)

UK Government, 2023. UK-Netherlands cooperation in quantum science and technologies: memorandum of understanding. GOV.UK (Accessed on 28 December 2023)

UK Government, 2023. National Quantum Strategy. GOV.UK (Accessed on 17 January 2024)

IBM Newsroom, 2023. IBM Launches $100 Million Partnership with Global Universities to Develop Novel Technologies Towards a 100,000-Qubit Quantum-Centric Supercomputer.

IMD, 2023. World Digital Competitiveness Ranking 2023

Institute Q, 2023. Finnish Quantum Agenda. (Accessed 09 January 2024)

Jaeger, L., 2018. A Second Quantum Revolution. Springer., p. 46

McKinsey, 2023. Quantum Technology Monitor (PDF).

Ministry of Economic Affairs and Employment of Finland, 2022. Artificial Intelligence 4.0 programme: Finland as a leader in twin transition – Final report of the Artificial Intelligence 4.0 programme. (PDF)

Ministry of Foreign Affairs of Denmark, 2023. National Quantum Strategy. (Accessed on 17 January 2024)

US National Science and Technology Councel, 2023. The National Quantum Initiative Supplement to President’s FY 2023 Budget (PDF)

QuantERA, 2023. Quantum Technologies Public Policies Report.

Quantum Delta NL. Quantum Delta in a nutshell (PDF)

Quantum Flagship 2016 Quantum Manifesto.

Research Council of Finland, 2023. Finnish Quantum Flagship. (Accessed on 17 January 2024)

Rodriguez, A., G., 2023. A Quantum Cybersecurity Agenda for Europe. European Policy Centre (PDF)

Sitra. Datatalouden verkoston syötteet hallitusohjelmaan: 3+1 tavoitetta kasvun ja kestävyyden vauhdittamiseen datalla. 2023.

Statista, 2023. Software – Finland (Accessed on 28 December)

US Government of State, 2022a. Joint Statement of the US of America and Denmark on Cooperation in Quantum Information Science and Technology

US Government of State, 2022b. Joint Statement of the US of America and Finland on Cooperation in Quantum Information Science and Technology

VTT. Most promising technologies. Perspectives on sustainable growth and effective innovation policy in Finland. 2022.

Author

Andrea G. Rodríguez is Executive Manager and Founder at PolicyPulse Hub, a deep-tech consultancy. She is also leading ImpaQT, a consortium of quantum technology companies based in Delft (NL). Before joining ImpaQT, she has worked as a Lead Digital Policy Analyst at the European Policy Centre (EPC) in Brussels and Lead Researcher at CIDOB (Barcelona Centre for International Affairs), where she researched the EU digital agenda and emerging technologies. She has advised the European Cybersecurity Forum for three consecutive terms and belonged to one of the expert groups leading up to the NATO 2030 Strategic Concept. She keeps engaged in NATO as a panelist for NATO’s Science and Technology Organization (NATO STO). Multi-award holder, in 2021, the Cybervolunteers Foundation recognised her as one of the 13 Spanish women to follow in technology, an initiative supported by Spain’s Ministry of Social Affairs and the 2030 Agenda.

Appendix 1: Stages of the study and interviewees

| Timeline | Description | Location |

|---|---|---|

| Sept.-Nov. 2023 | Desk-research and compilation of sources | Brussels |

| 7 Nov. 23 to 9 Nov. 23 | Visit to Denmark and the Netherlands and informal meetings with relevant actors | Copenhagen Amsterdam |

| 9 Nov. 23 to 16 Nov. 23 | Study trip to Finland | Helsinki/Espoo |

| Meeting with VTT | ||

| Meeting with CSC | ||

| Meeting with IQM | ||

| Meeting with SITRA | ||

| Finnish Information Security Cluster (FISC) | ||

| Finland’s Ministry of Employment and the Economy | ||

| 22 Nov. 23 to 23 Nov. 23 | Informal meetings with QUANTera actors | Madrid |

| Dec. 2023 | Analysis and online meeting with Business Finland | Brussels/Online |

| Jan. 2024 | Peer review, proofreading, and finalisation of the paper | Madrid Brussels |

| Jan. 2024 | Presentation of the study to the stakeholder and policy community in Finland | Espoo |

| Jan./Feb. 2024 | Review of the paper and incorporation of feedback | Brussels |

| 23 Feb. 2024 | Review meeting with Aalto University | Online |

| 1 March 2024 | Review meeting with Business Finland | Online |

Recommended

Have some more.