Responsibility in Sitra’s investment activities

Sitra invests its assets responsibly and profitably. For Sitra, responsible investment means considering not only return and risk but also environmental, social and governance (ESG) factors in all investment decisions.

Sitra’s guidelines and guidelines for responsible investment are the UN Principles for Responsible Investment (PRI), which Sitra signed by in 2015. The Global Compact principles are another international framework.

The practical implementation is based on the Guidelines for Responsible Investment approved by Sitra’s Board of Directors, which we last updated in 2022.

Funds and responsible investment

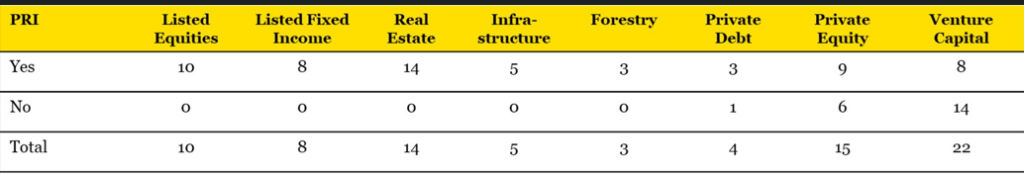

Sitra’s investments are mainly made through funds. Fund investments are managed by external asset managers who carry out individual investment analyses and select investment targets. The minimum requirement is that the asset manager has signed the PRI or has another responsible investment policy.

All Sitra’s asset managers managing listed equity and fixed income funds, as well as real estate, forestry and infrastructure funds, have signed the PRI principles (Figure 1). These asset managers manage 93% of the value of Sitra’s investments.

A significant number of our asset managers have set carbon neutrality targets, primarily at the asset manager level. Furthermore, eight of our funds have established fund-level carbon neutrality targets. A substantial portion of Sitra’s asset managers have pledged their commitment to the Net Zero Asset Manager Initiative (NZAMI). This initiative aims for investments to achieve carbon neutrality by 2050 or sooner and to align with the 1.5-degree temperature scenario. Nearly all asset managers involved in listed investments have committed to this initiative, although only a minority of those in unlisted investments have done so. Our asset managers are also dedicated to numerous other initiatives that promote responsible investment. The most popular of these include the UN Global Compact, Climate Action 100+, Nature Action 100, and various asset class-specific initiatives such as GRESB, BREEAM, and FSC.

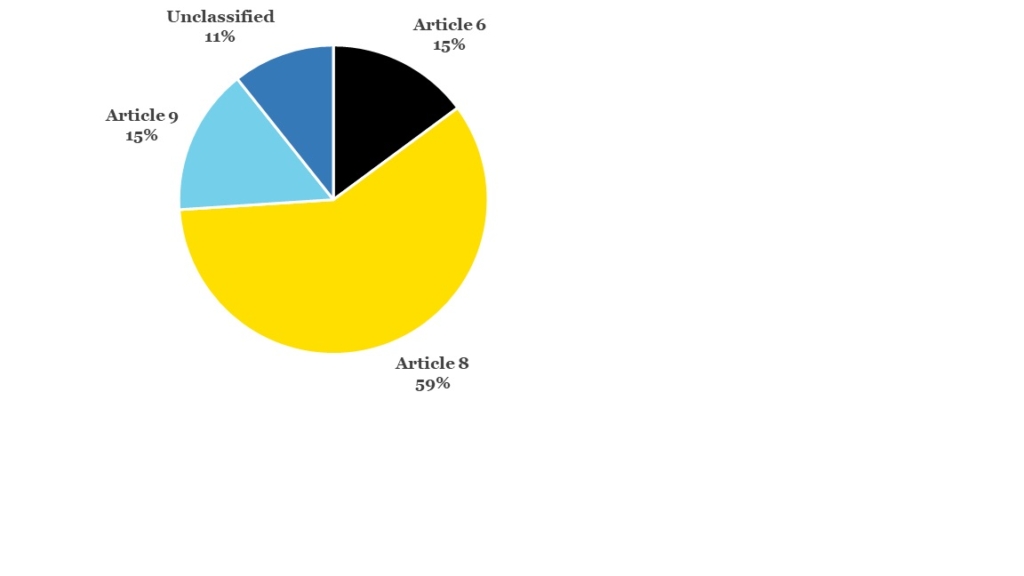

The EU Regulation on sustainability-related disclosures in the financial services sector (Sustainable Finance Disclosure Regulation, SFDR) entered into force in 2021. It classifies fund products into three categories according to their level of sustainability and obligates asset managers to disclose which category each fund belongs to. So far, no minimum requirements have been set for Sitra’s funds in terms of SFDR. The SFDR ratings of the funds are shown below according to their market value (Figure 2).

Most funds are classified as Article 8 funds, which means that these funds promote sustainability factors in their investment process. Article 6 funds are not obliged to take sustainability factors into account as part of the investment process. According to SFDR’s classification, the most sustainable fund category is Article 9, which specifically aims to achieve sustainability-related objectives.

The biggest change compared to the previous year is the increase in the share of Article 6 funds to 15% (2022: 3%) and the simultaneous decrease in the share of unclassified funds. This is due to the new classifications made by unlisted investments as Article 6 funds, when many were previously unclassified.

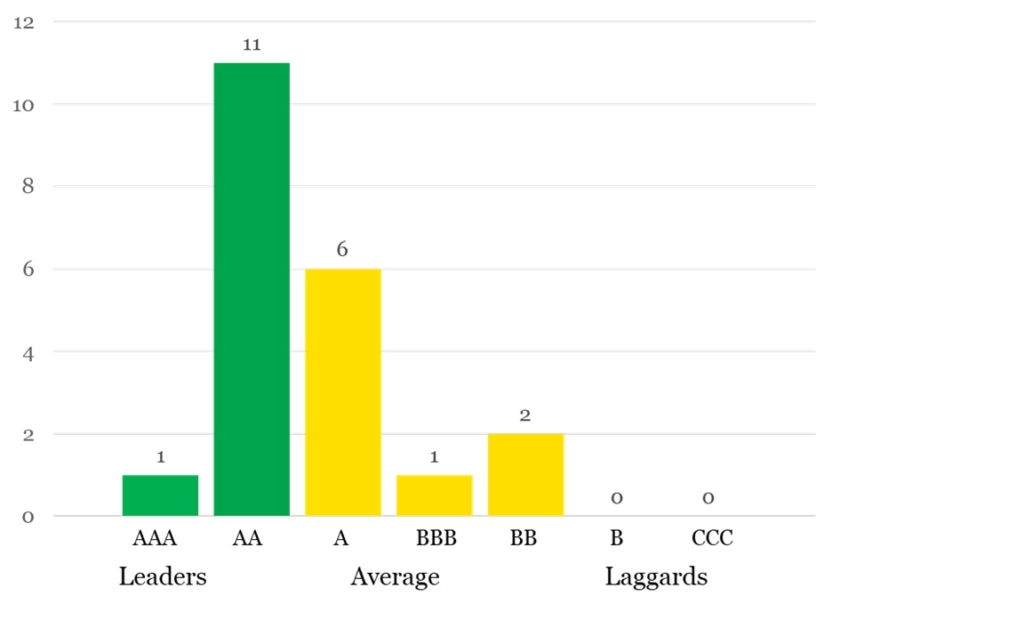

MSCI has assessed Sitra’s fund investments in 2023. The ESG rating of the portfolio remained AA, as in the previous two years, but there was some shift in the ratings of individual funds to lower ratings due to a change in the rating methodology of MSCI. Most of the funds selected for the portfolio were classified as leaders, and there were no funds classified as laggards.

One of the development points of Sitra’s responsible investment is taking biodiversity into account. As a first step, we joined the international Nature Action 100 initiative, in which committed investors demanded more ambition and action from large corporations to halt biodiversity loss. In addition, we are committed to reporting on Sitra’s nature-related investment risks and opportunities according to TNFD (The Taskforce on Nature-related Financial Disclosures) guidelines as of fiscal year 2024.

Engagement

As a fund investor, Sitra can influence its investments through discussions with asset managers. If engagement does not lead to improvement, the last resort is to sell the fund holding. ESG issues continued to be on the agenda at approximately 90% of fund manager meetings in 2023.

Sitra’s industry and norm violation screening is based on MSCI’s reporting, which covers Sitra’s listed equity and fixed income funds. In 2023, industry-related exclusions were successfully implemented in all but one fund that was decided to be divested. There were no significant norm violations.

Unlisted investments (real estate, infrastructure, private debt, private equity, and venture capital) are reviewed annually based on the reports submitted by asset managers. No deviations from Sitra’s industry restrictions were observed. The lack of access to information, especially in the private equity and venture capital asset classes, poses a challenge for an in-depth examination of sustainability issues. Asset managers are aware of these shortcomings and reporting is constantly evolving.

Sitra has been a support member of the Climate Action 100+ project since 2020. This project encourages companies to meet emission reduction targets in line with the Paris Agreement and to report on the risks posed by climate change to businesses. Based on a survey conducted in autumn 2023, Sitra’s investee funds had invested in 46 companies that Climate Action 100+ project aims to influence. We asked the asset managers of the funds that have invested in these companies to provide an account of the engagement measures targeted at the companies. The asset managers had actively sought to influence the companies. The most common measures included voting and bilateral discussions with companies.

PRI assessment of Sitra’s report on responsible investment

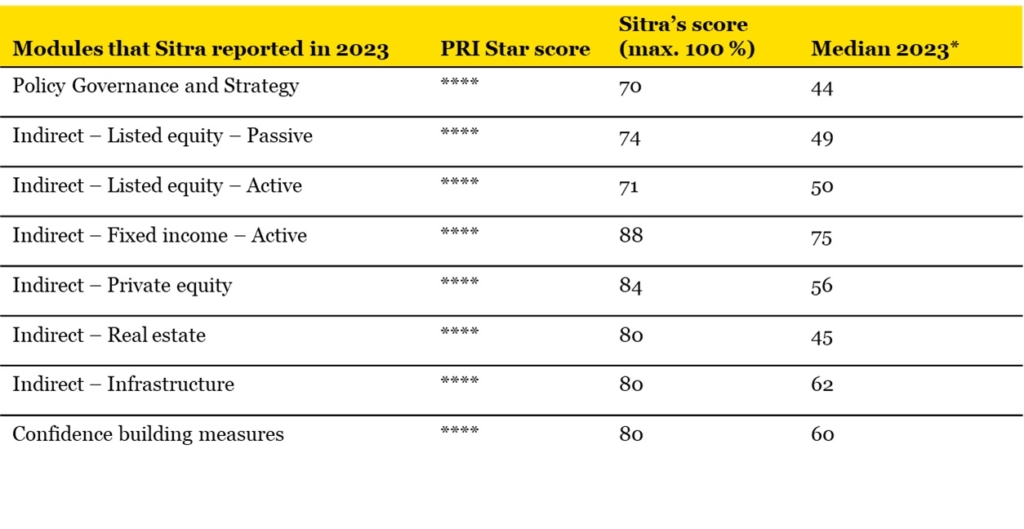

Responsible investment practices and measures are reported annually to the PRI, which assesses the practices. Sitra has been committed to the principles of the PRI since 2015, and Sitra’s Guidelines for Responsible Investment are also based on the PRI recommendations.

In early autumn 2023, we reported to the PRI on our responsible investment practices for 2022. The last time Sitra reported to the PRI was in 2021 regarding 2020, as the 2022 reporting was missed due to the renewal of the PRI’s reporting framework and scoring system, and the investor survey was not conducted. Reports and ratings based on the new reporting framework were published in December 2023 and, as in the previous reporting session, Sitra received four out of five stars in all areas according to the PRI scoring system. Below is a summary of the scores and medians of the respondents*. The PRI tightened its rating criteria for the latest reporting round, and the full five stars are even harder to achieve.

We scored well, for example, on climate-related data on reporting in accordance with the recommendations of the TCFD (Task Force on Climate-Related Financial Disclosures), measuring different temperature scenarios in the investment strategy, measuring the actions of top management from the perspective of responsibility, and influencing fund investments and monitoring them in various ways.

Based on the PRI assessments, we identified the lack of separate guidelines related to human rights and social issues as areas for improvement. In addition, we should develop our reporting on discussions with decision-makers related to responsible investment themes.

Climate targets

Climate change mitigation is one of Sitra’s most important sustainability goals, and we support, among others, the goals of the Paris Agreement.

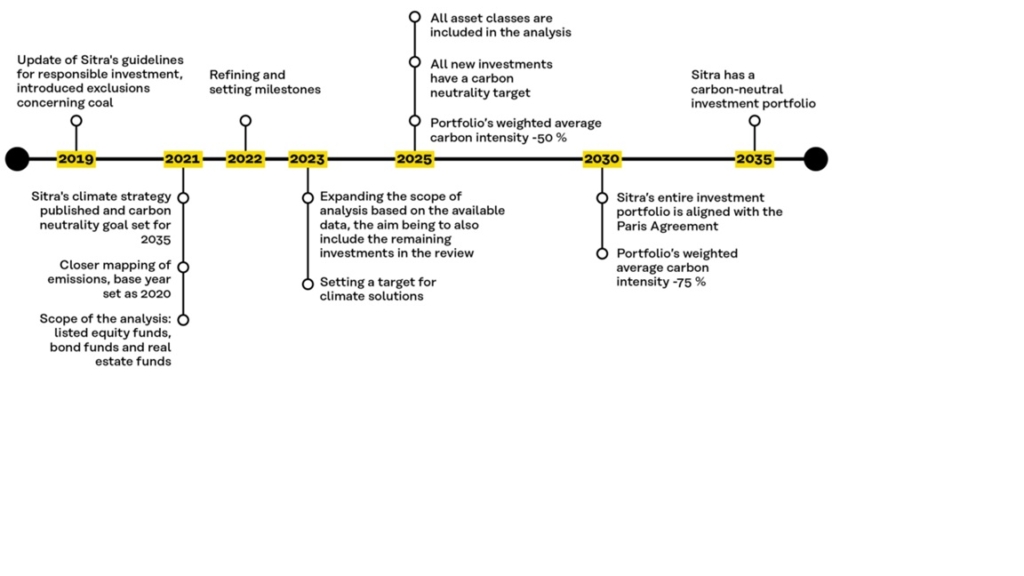

Sitra’s climate strategy for investments was published in spring 2021, and it was updated in 2023. The long-term objective is that all Sitra’s investments are in line with the Paris Agreement. The concrete objective is to achieve carbon-neutral investment portfolio by 2035 in accordance with Finland’s national target, provided that the investment environment enables the transition.

In reporting and analysing climate risks, we utilise the international TCFD reporting recommendation and framework (Task Force on Climate-related Financial Disclosures). The TCFD is an international reporting recommendation that instructs companies to report consistently on the financial risks and opportunities of climate change. According to the recommendation, it is important to determine the carbon footprint of investments, assess fossil fuel reserves and low- and high-carbon-emitting investments, as well as monitor the implementation of carbon emission limits in accordance with international climate agreements.

Carbon footprint

The climate impacts and risks of Sitra’s investments are mainly measured using the carbon footprint. Currently, the most important measure is weighted average carbon intensity, which measures the carbon-equivalent emissions of investees relative to their turnover and weighted by the market value of the investments.

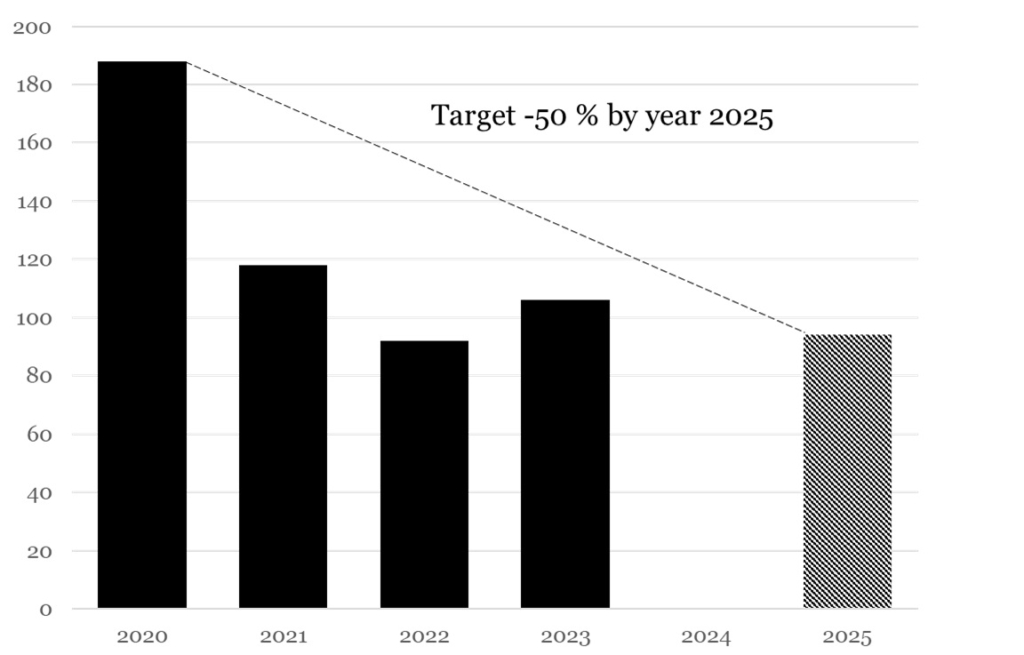

In the short term, Sitra’s goal is to significantly reduce the carbon intensity of its investment portfolio and to remain below the benchmark index. The goal is that the carbon intensity of Sitra’s investments will be at least 50% lower in 2025 than in the reference year 2020. The corresponding target for 2030 is 75%.

Carbon footprint and intensity numbers include emissions from the company’s own operations (scope 1) and indirect emissions related to purchased energy (scope 2). Indirect emissions (scope 3) are also reported, but no reduction targets have yet been set for them due to the related uncertainty.

At the end of 2023, the weighted carbon intensity of all Sitra’s listed investments was 106 tCO2e/M€ revenue. The two-year positive trend in weighted carbon intensity was interrupted and the intensity increased by around 15% compared to the previous year. The most significant explanation for the increase in weighted carbon intensity was the business restructuring of one company included in several funds, which significantly increased the weighted carbon intensity of that company. On the other hand, the same business arrangement lowered this company’s absolute carbon footprint and financed emissions, so conclusions should not be drawn based on individual key figures.

The funded emissions of listed investments decreased by approximately 14 per cent compared to the previous year. Through MSCI, we can calculate absolute emissions for approximately 48% of the value of the entire portfolio, although there is still significant uncertainty related to the figures, especially with regard to scope 3 emissions.

Financing climate solutions

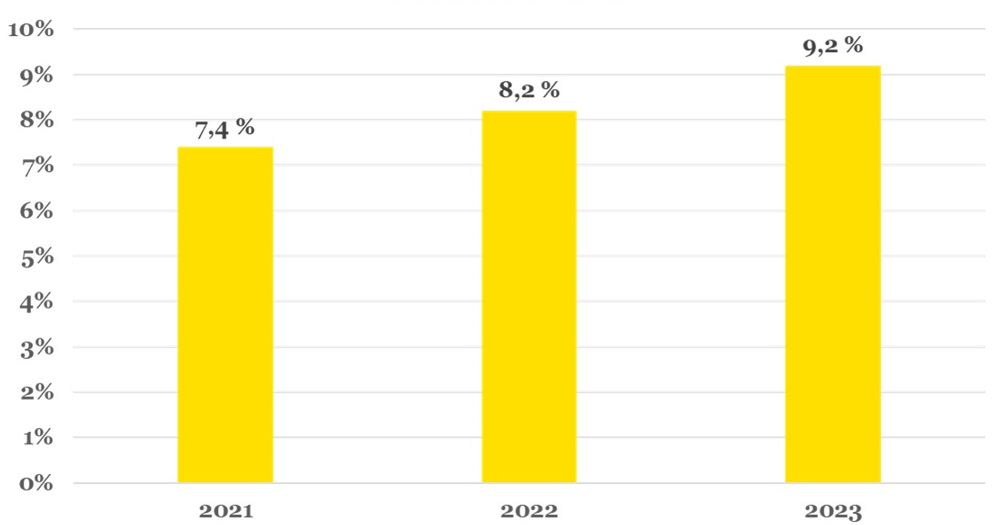

One important tool in mitigating climate change is funding climate solutions. Climate solutions refer to investing in targets which produce solutions enabling emission reductions and take the progress of climate change into account in their activities. As of yet, there is no unambiguous definition for climate solutions. Currently, the number of climate solutions in listed investments is measured by the so-called green revenue, which is the share of green revenue in companies’ total revenue, weighted by the market value of the investment.

The share of green revenue has grown moderately in recent years, standing at 9.2 per cent at the end of 2023. In addition to listed investments, our portfolio includes a significant amount of other financing for climate solutions, such as renewable energy infrastructure investments, sustainable forest investments, certified real estate investments and venture capital investments in companies developing climate solutions. However, commensurate reporting on these is not yet available.

Biodiversity

Biodiversity is a development target for Sitra’s responsible investment. Like climate risks, biodiversity loss can also affect investment portfolios regardless of asset type, sector and geographical area.

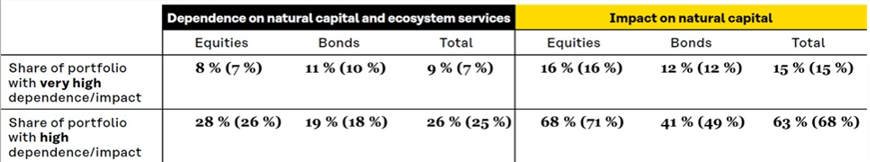

In 2023, SEB carried out its second biodiversity analysis on Sitra’s listed investments. As last year, the survey was carried out using the ENCORE tool (Exploring Natural Capital Opportunities, Risks and Exposure) and covered 58 per cent of all Sitra investments. ENCORE is a free tool (https://encore.naturalcapital.finance/en) developed by the UNEP Funding Initiative and its partners. It helps to understand how companies depend on nature and influence nature.

Almost 10% of the companies in the funds in Sitra’s portfolio are highly dependent on natural capital and ecosystem services, and around 15% have a very large impact on natural capital. About a quarter have a high dependency and more than 60% have a high impact. Dependencies have increased slightly compared to the previous year and the impacts have decreased or remained the same. Water resources were the most significant natural capital item, on which all companies depended. From the perspective of companies’ own impacts, almost all natural capital items were equally significant.

The ENCORE method helps to identify sectors and activities that are likely to be high-risk and significant impacts on nature. The model, on the other hand, does not enable information on financial risk, geographical weightings or the practices of individual companies to manage natural risks. However, the analysis can be used to identify sectors that should be targeted with measures, such as influencing and intensified further investigations.

An increasing number of our asset managers have started to consider biodiversity as part of their investment activities. Well over half of our funds have already assessed the risks, opportunities, dependencies and impacts caused by biodiversity in at least some way.

Disclaimer: Disclaimer: Although Sitra’s information providers, including without limitation, MSCI ESG Research LLC and its affiliates (the ”ESG Parties”), obtain information (the ”Information”) from sources they consider reliable, none of the ESG parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for, or a component of, any financial instruments or products or indices. Further, none of the Information can in and of itself be used to determine which securities to buy or sell or when to buy or sell them. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.