CORPORATE INVESTMENTS

Sitra invests in domestic early stage companies mainly through venture capital funds.

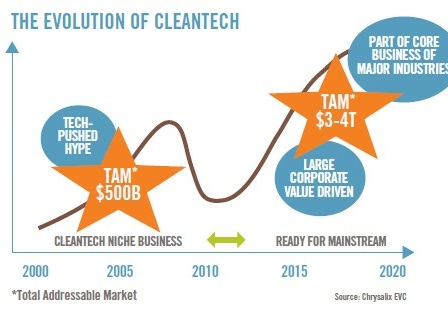

Business activities that promote sustainable well-being

The main focus of our investment activities has shifted towards fund investments. Sitra’s investment activities are market-driven; i.e. investment transactions are conducted in compliance with the same investment principles as those that govern other investors. In addition to achieving a high financial return, Sitra uses investments as a tool for promoting its strategic goals by selecting targets with a social impact, such as the more effective use of industry sidestreams or advancing the adoption of self-care solutions.

Emphasis on responsible and active ownership

Sitra’s operations comply with the principles of socially responsible investments. Sitra commits to the ownership and development of the portfolio company for an average period of 4 to 10 years. Exit from a portfolio company will be carried out according to a specific plan prepared together with all other co-investors. Sitra is an active owner and typically nominates a representative to the board of directors.

No subsidies to companies

Sitra grants no subsidies or free support to companies. Please visit Enterprise Finland for information on services and funding for small and medium-sized companies available from other organisations.

Investment portfolio

List of Sitra’s investments by company

LATEST