Sitra as an investor

Sitra’s work for the future is funded by the returns from its capital. Responsibility is an essential part of Sitra’s operation – also as regards investment activities.

What is it about?

The Bank of Finland and the Finnish Parliament gave Sitra an endowment capital of approximately 84 million euros. This endowment capital has laid the foundation for Sitra’s current investment assets, the returns on which provide financing for the future-oriented work at Sitra.

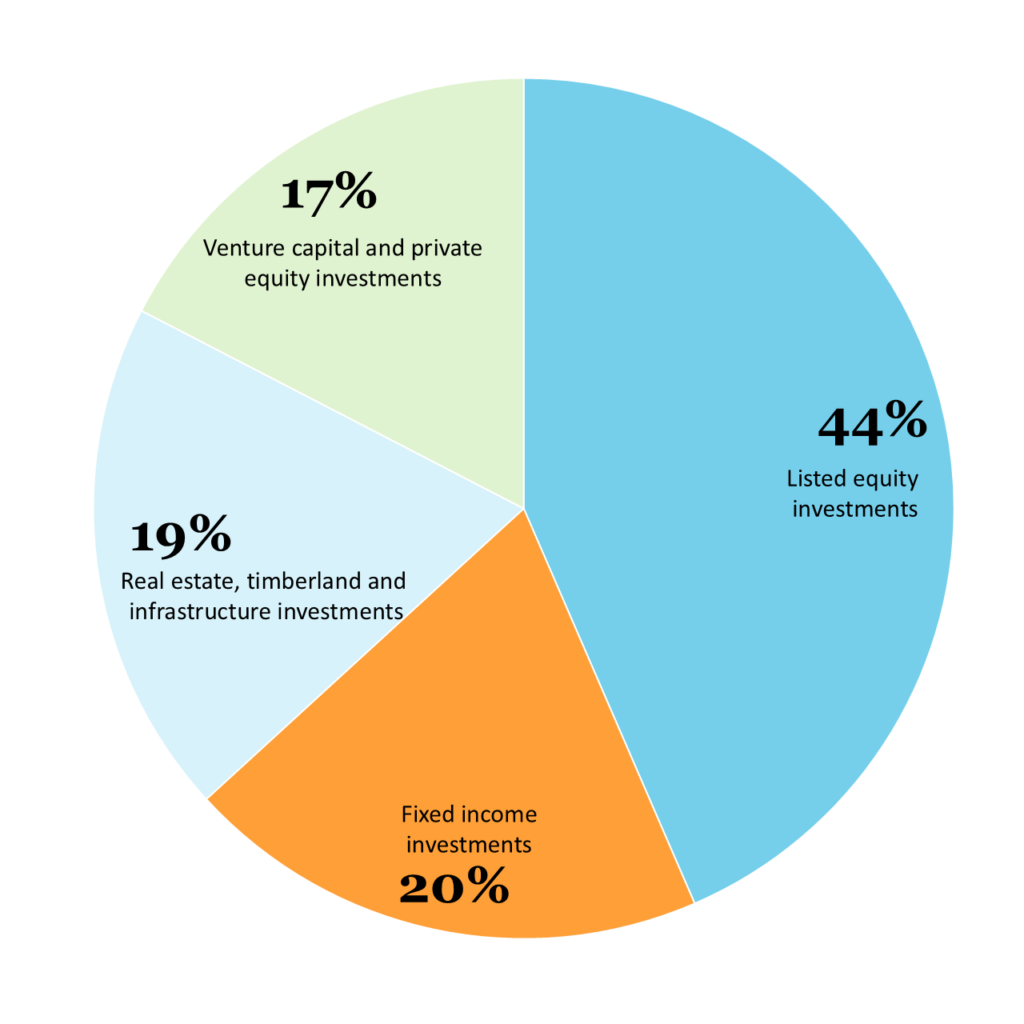

At the end of 2024, the market value of all Sitra’s investment assets was 986 million euros.

In the year 2024, the return on investments was 6.0 per cent. Taking inflation into account the real return was 5.3 per cent. The five-year average annual return on investments was 6.3 per cent and the average annual real return 2.9 per cent.

Sitra’s investment assets are mainly invested in funds. Sitra makes the decisions on the allocations, but the funds decide on the individual investment targets independently, as per the fund’s rules.

No new corporate investments have been made since 2014. At the end of 2024 Sitra’s investment portfolio still included four companies.

Responsible investment

We manage Sitra’s investments in a secure and profitable manner. In addition to risk and return, environmental, societal and corporate governance (ESG) issues are included in all investment decisions.

We signed the UN Principles for Responsible Investment (PRI) in 2015. Sitra’s responsible investment practices and actions are reported annually to the PRI, which assesses the reports. The practical implementation relies on Sitra’s Guidelines for Responsible Investment, which was most recently updated in 2022.

The purpose of Sitra’s climate strategy for investments is to mitigate climate change. This is also one of the primary sustainability goals in Sitra’s investment activities. Our goal is to achieve a carbon-neutral investment portfolio by 2035. The interim targets are as follows: in 2025, the carbon intensity of investments will be at least 50% lower and, in 2030, at least 75% lower than in the baseline year 2020.

Biodiversity is the latest focus in Sitra’s sustainable investments activities. During the spring of 2025, we will report for the first time on Sitra’s nature-related investment risks and opportunities. The reporting will cover the fiscal year 2024 and will be conducted in accordance with the TNFD recommendations (The Taskforce on Nature-related Financial Disclosures).

We continuously strengthen our expertise in ESG topics. In the fall of 2024, representatives from the investment team participated in a training organized by Sitra, which focused on utilizing the TNFD framework in various nature-related decisions. The training, aimed at Finnish financial professionals, consisted of a series of workshops attended by over 60 investors and asset managers.

National legislation and the international The UN Global Compact principles governing business and society are taken into account when addressing responsibility. Due to the fact that Sitra’s investments are mainly made through funds we require that our asset managers actively monitor companies’ ESG issues as part of their investment activities. The minimum requirement for fund investments is that the asset manager has signed the PRI or has a responsible investment policy.

Have a look at these, too!

Latest